Budget 2023: echoes of Argentina and the IRA

During the release of this year’s federal budget, a senior government official cited a Globe and Mail article that had appeared just days earlier, offering a portentous comparison between the contrasting economic fates of Canada and Argentina. Both countries began the 20th century as potential stars, its author argued, but by the end of the century Argentina had regressed from being one of the world’s most promising developed nations to assume the lesser status of a developing one.

Argentina’s decline was traced to some poor policy choices, made at key historic junctures. Canada has fared better over the same period, but those junctures now seem to be coming fast and furious, with no guarantee that this country’s success will continue. The current federal budget was therefore framed as a commitment to making the coming choices good ones.

“There is no more pressing issue,” stated the official, referring to the intense international competition to stake the high ground in technology, talent, and trade. Those areas include such highly fraught matters as securing the potential of artificial intelligence, nurturing a productive workforce, and shifting supply chains away from regimes that do not share Canada’s democratic values. In this tense atmosphere, not surprisingly, many observers find it hard to shake the sense that one wrong move could be nothing less than fatal.

“This is one of those moments,” concluded the official.

Finance Minister Chrystia Freeland underscored that point, citing US President Joe Biden’s recent visit to Ottawa, where he described the current moment as an inflection point that occurs only once in several generations. More specifically, she added, Canada is part of a global competition to define the economic future, where an unwillingness or inability to step up means joining Argentina and other also-rans.

When challenged on the scale and scope of the federal government deficit, as well as the introduction of an expensive and unexpected national dental plan, Freeland was therefore blunt and unapologetic.

“I feel that failure to put forward a comprehensive, effective, and adequately financed plan to be able to build the economy of the 21st century would mean consigning Canada to deindustrialization,” she said.

On that note, if Argentina serves as a cautionary tale from the past, the U.S. Inflation Reduction Act (IRA) set the stage for future foreboding. The budget announcement regularly referred to the implications of this massive American expenditure to jump-start that country’s economy. Canada’s efforts, as Freeland and others took pains to point out, contrast with those of the United States in many key respects.

“As the United States’ closest trading partner — and with our economies so closely intertwined — Canada stands to benefit from the IRA, both from the accelerated pace of technological development, and from new opportunities in North American supply chains for clean energy and technologies,” the budget stated.

At the same time, the IRA competes directly with Canada’s intention to create a more environmentally friendly economy. For example, the U.S. is attempting to do so with direct subsidies that will entice industries to adopt technologies that reduce greenhouse gas emissions. This latest federal budget touts Canada’s approach, which is described as “market driven”.

“Our world-leading carbon pollution pricing system not only puts money back in the pockets of Canadians, but is also efficient and highly effective because it provides a clear economic signal to businesses and allows them the flexibility to find the most cost-effective way to lower their emissions. At the same time, it also increases demand for the development and adoption of clean technologies.”

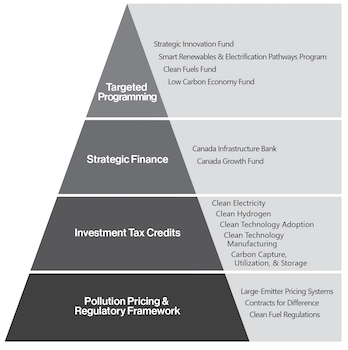

Freeland was eager to showcase the virtues of this particular Canadian choice, pointing to a pyramid image that summarized the strategy represented by the budget. At the base of this structure are regulatory mechanisms, such as carbon pricing, which are intended to provide the foundation for more targeted tools, such as tax credits targeted at investment in specific technologies, such as carbon sequestration or hydrogen manufacturing.

Whether those investments occur may depend on what happens at the next level of the pyramid, containing two major financial resources: the Canada Infrastructure Bank and the Canada Growth Fund. The former, according to the budget, will put “at least” $10 billion into what is described as “clean power”, plus another $10 billion for “Green Infrastructure”. In addition, Natural Resources Canada is slated to receive $3 billion over 13 years for projects such as its Smart Renewable and Electrification Program, which includes the addition of new transmission lines to the national grid.

As for the $15 billion Canada Growth Fund, the budget promised the introduction of legislation that would allow the Public Sector Pension (PSP) Investment Board to manage these assets. This federal crown corporation, which already oversees $225 billion in assets, is to handle the Growth Fund as an entirely separate portfolio.

“By partnering with PSP Investments, the Canada Growth Fund will be able to move quickly and begin making investments to support the growth of Canada’s clean economy,” stated the budget. “As the government committed in the 2022 Fall Economic Statement, the Canada Growth Fund will begin investing in the first half of 2023.”

At the top of the pyramid are even more narrowly targeted entities, such as the Strategic Innovation Fund, which the budget proposed giving $500 million over 10 years to support the development of clean technologies. Absent from this list was the Canada Innovation Corporation (CIC), perhaps because its mandate more closely resembles the American-style direct support for industry, rather than Canadian market incentives for industry to follow.

Read more: New innovation agency’s success hinges on its private sector leadership, experts say

The budget did refer to legislation launching the CIC, which will set in motion another major shift in the country’s innovation landscape — the removal of the Industrial Research Assistance Program from the purview of the National Research Council (NRC). While the budget release did not prompt any formal discussion of what else might change at NRC, updates and enhancements to this institution’s operation were promised through “legislative amendments to the National Research Council Act, as well as any other consequential, coordinating or transitional amendments as necessary, to provide the National Research Council operational flexibilities that will better ensure it can provide hands-on support to Canada’s innovators through timely access to specialized facilities and expertise.”

The budget also responded to calls for businesses to remain in Canada through Employee Ownership Trusts. “The government welcomes stakeholder feedback on how best to enhance employee rights and participation in the governance of Employee Ownership Trusts. These changes would take effect for the 2024 tax year, and would reduce federal revenues by $20 million over five years, starting in 2023-24.”

Such a move may be emblematic of the federal government’s stated desire to pave the way for the private sector participation that Canada will need to match its global competitors.

“This approach is not about the government picking individual corporate winners in an effort to engineer a preferred vision of the economy in 2050,” the budget document concluded. “That approach did not work in the past, and is even less likely to work in today’s environment of rapid technological change. The tax incentives and investment supports proposed in Budget 2023 are designed to set a framework for boosting overall investment, while leaving the private sector to determine how to invest based on market signals.”

R$

Some of Budget 2023’s highlighted expenditures

| Target | Amount (in millions) | Duration | Start Year |

| Tax Credits | |||

| Clean Energy Investment | 6,300 | four years | 2024-25 |

| Clean Technology Manufacturing | 4,510 | five years | 2023-24 |

| Clean Hydrogen Investment | 5,560 | five years | 2023-24 |

| Carbon Capture Investment | 516 | five years | 2023-24 |

| Other Initiatives | |||

| Clean Electricity Projects | 1,088 | five years | 2023-24 |

| Clean Technology Projects | 294 | four years | 2024-25 |

| Investing in Forest Economy | 368 | three years | 2023-24 |

| Canadian Leadership in Space | 508 | five years | 2023-24 |

| Dairy Innovation and Investment | 196 | four years | 2024-25 |

| College Research to Help Businesses | 109 | three years | 2023-24 |

| Organizations: | |

| People: | |

| Topics: |

Events For Leaders in

Science, Tech, Innovation, and Policy

Discuss and learn from those in the know at our virtual and in-person events.

See Upcoming Events

You have 0 free articles remaining.

Don't miss out - start your free trial today.

Start your FREE trial Already a member? Log in

By using this website, you agree to our use of cookies. We use cookies to provide you with a great experience and to help our website run effectively in accordance with our Privacy Policy and Terms of Service.