The Short Report: September 11, 2024

GOVERNMENT FUNDING

DIGITAL, Canada’s federally supported global innovation cluster for digital technologies based in Vancouver, announced co-investments of more than $53 million for 11 artificial intelligence-focused projects spanning the health, mining, education, agriculture and ocean sectors. The $53 million invested by DIGITAL is expected to leverage an additional $106 million in partner contributions. The projects are using generative AI to: rapidly discover novel and better medicines; identify lung abnormalities on chest x-rays in real time; develop human-like intelligence in general purpose robots; reduce disruption to running water in rural communities; enable immersive, no-code training environments in Canada's naval, aviation and security industries; target narrow-vein critical mineral deposits; and more. Examples of these new technologies and collaborations include:

- Led by Agi3 (Winnipeg), this consortium is leveraging AI to generate hyper-individualized, actionable insights and personalized risk profiles for a variety of purposes such as crop insurance, finance and sustainability within the agricultural sector. The resulting enhanced farm-level decision making will support addressing impacts on global food security from supply chain bottlenecks, decreasing total land under crop and rapidly changing climates.

- Led by Ideon Technologies (Richmond, B.C.), this consortium is delivering an AI-powered subsurface imaging and intelligence solution to the global mining industry that reduces time to market, cost, risk and environmental impact, while facilitating development of the sustainable critical metals supply chains needed to fuel the energy transition.

- Led by Satisfai Health (Vancouver), this consortium is accelerating the development of AI-driven software that conducts automated measurements of intestinal ultrasound images as a less invasive, point-of-care, and less expensive solution than colonoscopies and other traditional radiological imaging to monitor and treat inflammatory bowel disease, a condition which currently impacts over 320,000 Canadians.

- Led by Medtronic Canada (Brampton, Ont.), this consortium is integrating multiple AI-driven technologies to prevent and manage pressure injuries, also known as bedsores or pressure sores, which currently affect 26 percent of patients across Canada and degrade quality of life for patients often already experiencing severe illness or debility at their most vulnerable times, while requiring costly and long hospitalizations to address.

- Led by Impro.AI (Vancouver), this consortium is scaling AI-driven assistant technology to help guide corporate performance strategists step-by-step on how to improve employee performance, as a key to organizational growth and productivity.

- Led by Calabrio Canada (Vancouver), this consortium is developing an AI-driven platform to manage both virtual and human agents for telemedicine and patient contact centres, enabling positive patient experiences and addressing Canada’s increasing care worker shortage with projections of over 100,000 nurses by 2030.

- Led by SeafarerAI (Clifton Royal, N.B), this consortium is building an AI-powered architecture for real-time monitoring of underwater noise, which has doubled in intensity within the north Pacific Ocean over the past 60 years, threatening marine mammals and endangered species.

- Led by Fluid AI (Kitchener, Ont.), this consortium is developing an AI-powered postoperative patient management platform that accurately assesses the risk of postoperative complications, such as anastomotic leaks and respiratory depression following general and gastrointestinal surgeries. These insights will be used to assist surgeons in making quicker and more informed decisions regarding patient care, with earlier interventions providing potential for patients to go home sooner and healthier.

- Led by Goosechase (Kitchener, Ont.), this consortium is developing an AI agent to empower educators by helping to create high-quality tailored interactive learning experiences for their students.

- Led by Agnico Eagle Mines Limited (Toronto), this consortium is introducing innovative geotechnical and geometallurgical tests, integrating automated drill core scanners and AI methodologies to create better 3D block models of ore deposits with enhanced geotechnical, mineral processing and environmental characteristics. The result will address the challenges of conventional approaches in generating these 3D block models, applicable to both gold and critical minerals required in green and digital technology solutions.

- Led by Expeflow (Waterloo, Ont.), this consortium is developing AI agents that will work alongside mental health professionals automating time-consuming administrative tasks, protecting patient data and freeing up valuable clinician time.

“By uniting industry leaders, innovators and academic partners, and focusing on commercialization, talent development and AI adoption frameworks, we’re solving today’s challenges and building the environment to accelerate breakthrough innovation that keeps Canada at the cutting-edge of global AI innovation,” Sue Paish, CEO of DIGITAL, said in a statement. DIGITAL

Housing, Infrastructure and Communities Canada (HICC) announced a joint investment of more than $89 million by the Government of Canada, Government of British Columbia and local partners to support 17 green infrastructure projects across B.C. The federal government is investing more than $29 million through the Green Infrastructure Stream of the Investing in Canada Infrastructure Program. The B.C. government is investing $30 million through the CleanBC Communities Fund, and local partners are contributing a combined $29.9 million and are responsible for any additional costs. Project examples include:

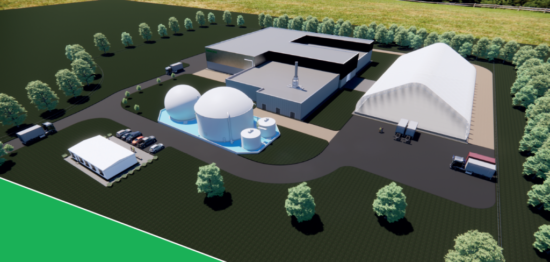

- More than $7.3 million for a project in the Regional District of Greater Vancouver, to construct a facility to convert biogas into renewable natural gas for the FortisBC grid and recover waste heat to replace gas-fired heating in the Northwest Langley Wastewater Treatment Plant.

- Nearly $4.8 million for a project in the City of North Vancouver, where Lonsdale Energy aims to reduce greenhouse gas emissions by up to 40 percent. A new energy plant will displace natural gas consumption and increase the use of renewable energy by extracting heat from raw sewage to provide heating to over 15,600 residents served by a district energy system. The operational facility will include two water-to-water electric heat pumps with a heating capacity of at least five megawatts.

- More than $3 million for a project in the District of Stewart, for BC Hydro to construct the Treaty Creek Switching Station to supply KSM Mine with clean and renewable energy.

- More than $2.7 million for a project in the Township of Langley, for BC Hydro to construct a new circuit extension from the existing Fleetwood substation to provide customers with clean and renewable electricity.

Other projects across the province include a geothermal electric plant, a “living roof,” heat pump installations, a district energy system, energy efficiency retrofits and modernization for community and health centres, and electrification connections that will provide buildings with access to clean and renewable electricity. HICC

Prairies Economic Development Canada (PrairiesCan) announced a federal investment of more than $15.6 million for 16 projects across Alberta providing innovators access to specialized equipment and knowledge to test, refine and commercialize their advanced products and technologies. Projects are focused on a wide range of key economic sectors, including digital technology, advanced manufacturing, life sciences and clean technology. Examples of projects receiving support include:

- The Smart Sustainable Resilient Infrastructure Association is receiving more than $3 million to enable over 20 Alberta business to participate in its Green Building Technology Network. This industry-led approach is accelerating the adoption of innovative low-carbon building solutions by facilitating real-world technology demonstrations, delivering business growth services for small businesses, and sharing the latest expertise regarding cleaner building technologies, products and practices.

- The University of Calgary is receiving $2.35 million to establish the Canadian Cyber Assessment, Training and Experimentation Centre, where researchers, students, entrepreneurs and businesses can test cybersecurity solutions and participate in cyberattack mitigation training leading to better protected and less vulnerable organizations.

- ELIXR Simulations is receiving more than $1.3 million to deliver training and launch business development tools to accelerate the production and adoption of extended reality technologies, better positioning Alberta businesses to capitalize on rapid growth in the immersive technology sector.

- The University of Alberta is receiving more than $1.3 million to establish the Canadian Cluster for Laser and Advanced Manufacturing – an applied research, networking and information hub that will facilitate the expansion of Alberta laser cladding manufacturers into new industries and international markets.

- Northwestern Polytechnic in Grande Prairie is receiving over $390,000 to develop and provide sugar and botanical testing services at the National Bee Diagnostic Centre in Beaverlodge to support the Canadian beekeeping industry and establish a Canadian honey authentication system to increase sales of Canadian-made honey in national and international markets.

These investments are expected to directly support more than 1,100 jobs and leverage approximately $11 million in additional funding from other orders of government and industry. PrairiesCan

Natural Resources Canada (NRCan) announced almost $8.4 million in investments to Toronto-based Cyclic Materials Incorporated and Montreal-headquartered Green Graphite Technologies Inc. (GGT) under NRCan’s Critical Minerals Research, Development and Demonstration program. This funding will support the development of a circular economy for rare earth elements for permanent magnets and the recycling of graphite for use in lithium-ion batteries in Canada. Cyclic Materials will operate a demonstration plant that produces high-purity mixed rare earth oxide and a cobalt-nickel mixed hydroxide product from various recycled materials, using its proprietary physical and hydrometallurgical processes. Rare earth elements are metals used in various applications, but the highest value application is permanent magnets, used in electric vehicle motors, wind turbines and many electronics such as computers and cell phones. This project will validate operating conditions to support future scale and commercial operations. NRCan is providing $4.9 million to Cyclic Materials for this initiative. GGT will demonstrate their GraphRenewTM technology’s ability to cost-effectively and sustainably recover and transform graphite from secondary sources into lithium-ion battery-grade graphite. The upgraded graphite will undergo battery cell performance testing, and larger quantities will be sent to major battery cell manufacturers to begin certification testing. Lithium-ion batteries' main target use is EVs, but they are also used in solar panels and electronics such as cell phones and laptops. The project could address a significant knowledge gap in the lithium-ion battery industry while focusing on recycling batteries and upgrading spent graphite, enabling commercialization and improving circularity in the graphite value chain domestically. NRCan is providing $3.5 million to GGT for this initiative. NRCan

The Federal Economic Development Agency for Southern Ontario (FedDev Ontario) is investing $5.2 million in Guelph, Ont.-based Boundless Accelerator (previously known as Innovation Guelph). Boundless Accelerator will deliver the new Southern Ontario Environmental Impact Fund, which will consist of two programs, a revised cohort of the i.d.e.a. Fund, and the Sustainable Impact Program, to accelerate cleantech and circular economy growth in southern Ontario. Through the i.d.e.a. Fund program, Boundless Accelerator will work with a network of Regional Innovation Centres partners, including Innovation Factory, Innovate Niagara, LaunchLab, TechAllliance of Southwestern Ontario and WEtech Alliance, to co-deliver the i.d.e.a. Fund. This program will provide companies with access to business support and seed funding to develop and/or re-design green products, services, processes and technologies to reduce their environmental footprint. The application intake opens on September 9, 2024. For more information, including how to apply, visit the i.d.e.a. Fund website. Through the soon-to-be-launched Sustainable Impact Program, Boundless Accelerator will work with partner organizations targeting innovations to reduce their environmental impact. They will also work to support commercialization activities of high-potential scale-ups, providing them with the tools they need to become export and investor-ready. FedDev Ontario

The Government of Quebec is providing more than $4.1 million to the Institut national de la recherche scientifique to implement new research and innovation infrastructure in its Containment Level 3 (CL3) laboratory at the Centre Armand-Frappier Santé Biotechnologie in Laval. An infrastructure classified as CL3 makes it possible to handle, under infectious and highly safe research conditions, pathogens potentially dangerous to human and animal health. The acquisition of state-of-the-art equipment will complement the current CL3 facilities and will allow for a continuum of research from the study of a virus in the infected host to the molecular level, which will provide a better understanding of how the disease develops and spreads. The Level 3 laboratory also will have a liquid effluent treatment system that will provide the ability to work with non-indigenous Risk Group 3 and/or biosafety pathogens, such as MERS-CoV, Japanese encephalitis virus or Rift Valley fever virus. INRS

Pacific Economic Development Canada (PacifiCan) announced $3.5 million for eight Vancouver Island-based organizations to advance innovation, attract visitors and boost the region’s leadership in areas such as ocean technology and Indigenous tourism. Open Ocean Robotics, a marine robotic vehicle company, is receiving $800,000 from PacifiCan’s Business Scale-up and Productivity (BSP) program. This investment will help the company scale up production of its Uncrewed Surface Vehicles – solar-powered, autonomous boats that provide real-time ocean information. The technology helps researchers monitor ocean conditions and track marine life in challenging environments. Other organizations receiving a total of $1.7 million in funding through PacifiCan’s BSP program and Jobs and Growth Fund are Fluorescent Design, Industrial Plankton and Namgis Business Development Corporation. PacifiCan’s funding also includes almost $1 million in support for four local organizations through PacifiCan’s Tourism Growth Program. PacifiCan

Agriculture and Agri-Food Canada (AAFC) announced an additional $3.5 million investment, from the Government of Canada and the Government of Ontario, in the Ontario Agri-Food Research Initiative (OAFRI). The funding will support the development and adoption of new technologies for farmers, food processors and agri-businesses that will enhance their competitiveness and growth. Funded through the Sustainable Canadian Agricultural Partnership between Ontario and Canada, this additional intake will support investments in the applied research, pilot and demonstration, and knowledge translation and transfer streams. More than 100 research and innovation projects and activities have received funding through the latest intake, which includes 67 applied research and pilot and demonstration projects and 10 commercialization projects. More than 30 businesses are also receiving specialized expert mentoring through the Grow Ontario Accelerator Hub. Examples of projects funded under the last OAFRI intake include:

- A digital animal biosecurity product for swine and poultry farmers.

- Developing solutions to detect contamination at food processing plants and large farms.

- Improving data management and communication for Ontario dairy farmers with a digital platform to boost efficiency. AAFC

The Federal Economic Development Agency for Southern Ontario (FedDev Ontario) is investing $2 million in GreenCentre Canada to support the delivery of the Advance-ON program, which is now open for applications. The program will assist up to 40 small and medium-sized enterprises in the chemistry and materials sector in southern Ontario as they commercialize their products and scale their businesses. The businesses will benefit from customized technical projects executed by GreenCentre’s expert team of scientists at a significantly reduced cost. This critical work will accelerate market entry by positioning SMEs for private sector investment. This program aligns with the Government of Canada’s priority to foster innovation in green technology and contribute to building a vibrant sector. FedDev Ontario

The Government of Alberta is investing more than $1 million in the new Alberta Centre for Labour Market Research aimed at providing reliable labour market insights for Albertans and to plan long-term for career and training needs. The centre, established on February 12, 2024, will comprise 25 labour market researchers across five higher education institutions in Alberta, including Athabasca University, Mount Royal University, University of Alberta, University of Calgary, and University of Lethbridge. Operating out of U of A’s College of Social Sciences and Humanities, the centre will be funded by Alberta’s government with an annual grant of almost $400,000 (2024-2026). The centre is part of the Alberta at Work initiative, aimed at enhancing the labour market information available to Albertans. By investing in Alberta’s labour market research environment, the government said it is empowering researchers to explore critical policy issues that directly affect Albertans. Undergraduate and graduate students are also being equipped with the knowledge and skills needed to understand and address labour market challenges in the future. Govt. of Alberta

The Ontario-based Next Generation Manufacturing Canada (NGen) global innovation cluster launched its $50-million Advanced Manufacturing Homebuilding Challenge. NGen is seeking partnerships to innovate in:

- Accelerated house production, greener processes and cost reduction.

- AI, robotics, and automation for efficient, customizable home manufacturing.

- Sustainable materials and greener energy solutions.

- Standardizing designs and enhancing quality control.

Key dates and deadlines are:

- (5 p.m. ET) – Project screening deadline.

- Financial due diligence deadline.

- (5 p.m. ET) – Final application deadline.

Application & Finance Guides now available online.

RESEARCH, TECH NEWS & COLLABORATION

The Natural Sciences and Engineering Research Council of Canada (NSERC) and UK Research and Innovation (UKRI) entered into a formal arrangement that will serve as a framework to build on existing collaborations and investigate new opportunities for cutting-edge research and training activities between both organizations. This arrangement enabled NSERC and UKRI to call for research proposals on quantum technologies that aim to advance research in quantum communications and/or quantum sensing. The arrangement also enabled NSERC and UKRI sustainable critical minerals research partnerships, with funding from NSERC’s Alliance Missions grants. This partnership will also foster the shared commitment by NSERC and UKRI to ensure that equity, diversity and inclusion principles are considered in all research-related activities. NSERC

Penn-co Construction is suing the University of Manitoba, claiming the university owes the company millions of dollars in unpaid costs associated with building a first-of-its-kind marine multidisciplinary research facility. The lawsuit, filed August 30 in the Court of King’s Bench, came just three days after the University of Manitoba celebrated the grand opening of the Churchill Marine Observatory (CMO). Penn-co Construction is seeking roughly $2.6 million from the university, claiming inadequate design plans and the COVID-19 pandemic caused project expenses to increase without additional compensation. Penn-co won both bids in a two-phase process to build the facility, at a collective cost of around $20.5 million. Although it has not yet responded to the lawsuit, the university said it is reviewing the claim and intends to file a countersuit against the Manitoba-based construction firm. The observatory, located near the Port of Churchill, is Manitoba’s first marine research facility and is dedicated to the study of the Hudson Bay and Arctic Ocean. Designed to help detect and mitigate oil spills, it will also support studies on Arctic marine transportation and climate change. The research infrastructure of the CMO includes three core facilities:

- The Ocean-Sea Ice Mesocosm incorporates outdoor pools used to study processes across the ocean, sea ice and seawater interface, as well as the detection and mitigation of contaminants associated with marine shipping.

- The Environmental Observing system is a series of taut-line moorings located along the main shipping channels across Hudson Bay, providing a state-of-the-art monitoring system used for larger studies in the Arctic environment.

- The third core facility is the Research Vessel which is operated in partnership with the Arctic Research Foundation, to facilitate ship-based studies around Hudson Bay.

A dedicated atmospheric station and radar systems at the CMO are now online, providing nearly continuous observation of changes in the air and sea ice at the facility and in the nearby area. Several research projects with international participation are scheduled to take place at the CMO starting November 2024. The facility is made possible by a combined investment of $45 million from the Canada Foundation for Innovation, the Provinces of Manitoba and Alberta, and many other partners. The Free Press, University of Manitoba

London, Ont.-based AI company Deep Breathe, which develops AI-powered ultrasound diagnostic systems, took the top prize of $95,000 at the 2024 XTechInternational competition, hosted by the U.S. Army. xTechInternational is an international competition that invites companies from across the world to showcase technologies with potential applications in military environments. This year's competition attracted submissions from more than 100 companies, spanning various industries and academic institutions. Deep Breathe emerged as the winner among 12 finalists that presented their solutions to a panel of military technology experts. Deep Breathe's solution harnesses deep learning algorithms to automate and enhance the interpretation of portable lung ultrasound images, offering a faster, more accurate alternative to traditional methods. This innovation is particularly crucial in settings where timely diagnostic information can significantly impact outcomes. Deep Breathe

NASA launched a rocket carrying experiments developed by teams from nine universities and colleges – including the University of Alberta – in August. A Terrier-Improved Malemute sounding rocket, carrying student experiments for the RockSat-X mission, launched from NASA’s Wallops Flight Facility in Virginia. The rocket reached an altitude of 164 kilometres. The payload will be recovered from the Atlantic Ocean, and the experiments will be returned to the student teams for analysis. UAlberta is the first postsecondary institution outside of the U.S. to be included in this program. The UAlberta project is focused on understanding the Sun’s effect on Earth’s atmosphere. “This sort of fundamental physics work is essential to us populating other parts of the solar system and getting off this floating rock we all live on,” UAlberta project manager Eric Halliwell told CBC. NASA

Creative BC and the Canada Media Fund (CMF) announced a new program that will invest $1 million in grants of up to $200,000 to support the growth of video game businesses in British Columbia. Funding will be available through the Video Games Business Development Program, a pilot aimed at creating new funding opportunities to foster the success and growth of video game companies based in B.C. The program will offer grants to B.C.-owned and controlled companies to develop their own creative intellectual property, encouraging growth for mid-level and experienced studios beyond the constraints of project-by-project funding. The program will support video game companies with a significant track record of production in the province, and proposals must be business-focused with plans for ongoing content production and capacity building. An evaluation panel of industry professionals representing the groups this program is intended to serve will be established by Creative BC and the CMF to determine successful projects based on business viability, impact and additional criteria, as outlined in the program guidelines now available online. This partnership is supported by the Government of British Columbia’s announcement on April 19, 2023 of a $3-million investment over three years to support innovation and growth for independent B.C.-owned interactive digital media companies through 2027. Creative BC

The Montreal Port Authority (MPA) announced that since January 1, 2024, the Port of Montreal's Grand Quay has been surpassing a carbon footprint milestone it set by opting for a new energy supply solution. By adding renewable natural gas (RNG) distributed by Énergir to its energy sources, the Grand Quay building is now supplied with 100 percent renewable energy. The MPA chose to shift from fossil natural gas, previously used for heating and cooking systems in the Grand Quay's event rentals, to RNG (a renewable source of energy produced from organic waste). This switch to RNG makes it possible for organizers to greatly improve the carbon footprint of their events at the Grand Quay. The Grand Quay integrated several sustainable development components during the project to rehabilitate the former Alexandra Pier and Cruise Terminal. They include:

- Installation of one of the largest green roofs in the city, featuring 24,000 plants and a long boardwalk.

- Landscaping of a lawn and lowering the quay to bring it closer to the river.

- Introduction of shore power for cruise ships visiting Montreal, enabling them to turn off their engines during their stopover and limit their greenhouse gas emissions.

- Use of a Solucycle robot to collect and process the Grand Quay’s organic waste, making for optimized waste management. Montreal Port Authority

The Alberta Securities Commission (ASC) has partnered with the Edmonton Police Foundation (EPF) and the Edmonton Police Service (EPS) to launch the ScamShield: Investor Protection Challenge, to seek new and innovative solutions to address the growing threat of online crypto investment fraud. As part of EPF’s Community Solutions Accelerator, the Challenge is designed to complement the work already being done by the ASC and police. With a prize pool of up to $130,000, this Challenge calls for innovative solutions to enhance investor protection and strengthen Alberta’s capital market. The ASC estimates that more than 60 percent of the $309 million of investment fraud reported to the Canadian Anti-Fraud Centre in 2023 was tied to crypto investment frauds. Fraudsters leverage technology and psychological manipulation to deceive investors through social media deepfake scams, romance scams, emotional manipulation and other online tactics. In Edmonton alone, there were more than 80 victims with combined losses of over $7 million last year. The true amount is likely higher because these crimes are vastly underreported, the ASC said. Those that do report provide valuable information on how scams are growing and evolving. This Challenge provides an opportunity for those in academia, technology and innovation to work together with enforcement partners to propose novel ways to stop further victimization locally and potentially on a national scale. Submissions will be accepted until November 4, 2024. More information on eligibility and evaluation criteria can be found online at www.herox.com/scamshield. ASC

The University of Windsor signed a memorandum of understanding with Ontario-based NEO Battery Materials focused on advancing new battery and energy storage technologies in Canada’s electric vehicle ecosystem. The partnership will leverage the synergies between industry and academia to drive innovation and competitive advantages in battery and sustainable mobility technologies. As a part of the agreement, NEO will collaborate with researchers in UWindsor’s Faculty of Engineering. Projects will focus on optimizing silicon anodes, fabricating multi-layer lithium-ion battery cells and developing novel component materials. The partnership will take advantage of provincial or federal funding programs for industry-academia joint development. Along with R&D, the collaboration aims to create commercialization pathways for new innovations. By jointly creating intellectual property, NEO and UWindsor will develop and bring to market new solutions that address the evolving needs of the EV and energy storage sectors. The collaboration will explore work opportunities to equip students with practical experience and create a pipeline of highly qualified personnel to fulfill the workforce needs of the growing EV sector. Neo Battery Materials

Sweden-based Northvolt’s $7-billion EV battery cell manufacturing gigafactory in Quebec could be delayed for up to 18 months, then-Quebec Innovation Minister Pierre Fitzgibbon wrote on X. Prior to his resignation as minister, Fitzgibbon noted on the social media site that the battery industry is slowing down worldwide and experts expect a period of stagnation, a slowdown that he said “could apply to Northvolt.” Northvolt had originally planned to start production in the Northvolt Six battery cell factory in 2026, but in July announced it was conducting a strategic review of its expansion plans but still intends to proceed with the Quebec factory. Northvolt has so far only stated in a media release that the strategic review could lead to a reassessment of the timetable. “In the meantime, engineering and design of the technology complex are ongoing, and site preparation work continues,” the company said. Normand Mousseau, scientific director of the Trottier Energy Institute at Polytechnique Montréal, told the CBC that a delay has implications and potential consequences. “If the investments are going forward elsewhere in North America, it means that we are losing competitiveness with respect to other places where battery factories are being built,” said Mousseau, noting that orders will go to plants that are being built. “All delays with respect to other places being developed is bad news in terms of the capacity to compete.” The Northvolt facility is backed by $1.34 billion in federal funding, $1.37 billion from the Quebec government, and another $4.6 billion in combined production incentives. Battery Industry

Swedish automaker Volvo Cars announced it is adjusting its electrification ambitions “due to changing market conditions and customer demands.” Going forward, Volvo said it’s aiming for 90 percent to 100 percent of its global sales volume by 2030 to consist of electrified cars, meaning a mix of both fully electric and plug-in hybrid models. The remaining zero to 10 percent of sales will allow for a limited number of mild hybrid models to be sold, if needed. “This replaces the company’s previous ambition for its line-up to be fully electric by 2030.” Volvo said there has been a slower than expected rollout of charging infrastructure, withdrawal of government incentives in some markets and additional uncertainties created by recent tariffs on EVs in various markets. “With this in mind, Volvo Cars continues to see the need for stronger and more stable government policies to support the transition to electrification.” Volvo said it remains committed to its long-term ambition of full electrification, and the company’s long-term investment plan and product strategy remains geared towards fully electric cars. The adjustment to its ambitions is not expected to have any material impact on the company's capital expenditure plans, Volvo said. By 2025, Volvo said it expects the percentage of electrified products to come in between 50 percent and 60 per cent. “Well before the end of this decade Volvo Cars will have a complete line-up of fully electric cars available. That will allow Volvo Cars to make the move to full electrification as and when the market conditions are suitable.” Volvo Cars

New York-based facial recognition startup Clearview AI was fined €30.5 million ($45.6 million) for building what the Netherlands’ Data Protection Agency (DPA) said was an illegal database, built without insufficiently informing people whose images appear in the database. DPA also issued an additional order, imposing a penalty of up to €5.1 million ($7.6 million) on Clearview for non-compliance. Clearview said it doesn’t have a place of business or any customers in the Netherlands or the European Union, or undertake any activities that would make it subject to the EU’s General Data Protection Regulation. “This decision is unlawful, devoid of due process and is unenforceable,” Jack Mulcaire, Clearview AI’s chief legal officer, told Reuters. DPA in a statement said Clearview hadn’t objected to its decision and would therefore be unable to appeal against the fine. In June, Clearview reached a settlement in an Illinois lawsuit alleging its massive photographic collection of faces violated the subjects’ privacy rights, a settlement lawyers estimate could be worth more than $67 million. Reuters

VC, PRIVATE INVESTMENT & ACQUISITIONS

Caisse de dépôt et placement du Québec, a global investment group headquartered in Quebec City, and Fonds de solidarité FTQ in Montreal announced an additional investment totaling $575 million in Montreal-based Énergir to support the company’s growth and the execution of its decarbonization and climate resilience plan. The plan includes developing renewable energy projects and renewable natural gas production plants, pursuing the deployment of dual energy in Quebec and the Zero Outages Initiative of its subsidiary, Green Mountain Power, in Vermont. Énergir is a diversified energy company with more than $10 billion in assets whose mission is to meet the energy needs of its 535,000 customers in an increasingly sustainable fashion, notably with renewable energy. The leading gas distribution company in Quebec, Énergir is also present in the U.S., where it produces electricity from hydro, wind and solar sources, in addition to being the primary distributor of electricity and the sole distributor of natural gas in Vermont. Énergir

Bank of America is investing US$205 million in carbon capture company Harvestone Low Carbon Partners, in exchange for Inflation Reduction Act tax credits. The deal is the first of its kind since the 2022 Inflation Reduction Act increased the tax credits available for capturing carbon and storing it underground. Harvestone, which produces corn ethanol blended with gasoline, captures carbon emissions produced at a plant in North Dakota. The company said its facility can capture all of its carbon emissions, totaling more than 200,000 tonnes annually. That is roughly equivalent to the annual emissions of about 42,000 gasoline-powered cars. Harvestone has plans for two other carbon capture projects in North Dakota and Indiana. The Wall Street Journal

Safe Superintelligence, an artificial intelligence research lab co-founded by former OpenAI chief scientist Ilya Sutskever, raised US$1 billion to build a safe and powerful AI system. Andreessen Horowitz, Sequoia Capital and SV Angel contributed to the funding round. NFDG, the venture capital firm of Nat Friedman and Safe Superintelligence co-founder Daniel Gross, also invested. Sutskever, a Canadian who studied under Geoffrey Hintion, was instrumental in developing OpenAI’s technology. He introduced Safe Superintelligence in June, shortly after leaving OpenAI. The venture aims to develop a powerful AI system within a pure research organization that has no intention of selling AI products or services in the near term. Safe Superintelligence plans to use the funds to acquire computing power and hire new staff. TechCentral

Venture Capital firm Luge Capital, which has offices in Montreal and Toronto, raised $96 million for its Luge Capital II fund, the company’s second fintech-focused round. Luge previously announced a $71-million first close of the fund. New commitments in this second closing came from Venture Ontario, Alberta Enterprise Corporation (AEC), AAF Management and other strategic limited partners. With this additional capital, the firm’s total assets under management has reached just over $180 million, across two funds. Luge Capital’s second fund will continue the firm’s focus on investing in early-stage fintech startups across Canada and the U.S., the fintech investor said. Luge has already made four investments from the second fund, one of which was Montreal-based inscora, which provides automated cyber risk assessment and sales enablement solutions for the insurance industry. The three other investments are expected to be announced shortly. Luge also announced that Ha Duong, formerly head of finance at Toronto-based firm Georgian, has joined Luge as vice-president of finance and operations. Luge Capital

California-based You.com, an AI-powered search and productivity platform, raised US$50 million in an all-equity Series B funding round. Toronto-based Georgian led the round, with participation from tech giants Nvidia and Salesforce Ventures, in addition to Day One Ventures. Richard Socher, former chief scientist at Salesforce, founded You.com in 2021. The company is pioneering a new category in the AI space: “productivity engines” – tools that aim to revolutionize how knowledge workers interact with information and complete complex tasks. VentureBeat

Toronto-based Northside Ventures closed its inaugural early-stage venture capital fund, securing $15 million. The firm, led by solo general partner Alex McIsaac, focuses on backing Canadian founders at the pre-seed and seed stages, particularly in artificial intelligence, vertical software-as-a-service, fintech, and cleantech sectors. Northside’s limited partners include institutional investors like Inovia Capital, Bain Capital Ventures, Intact Ventures, and Golden Ventures. The fund also attracted over 50 individual investors, including tech industry veterans from companies like Google, Uber, and Affirm. Northside Ventures has already deployed 40 percent of its capital across 15 companies, including Datacurve, Switch, and Veritree. The firm plans to make another 15 to 20 investments over the next two years, with a majority of the portfolio focused on Canadian founders building businesses either in Canada or the U.S. FoundersToday

Toronto-based startup Wombo, which specializes in consumer AI applications, raised $12.2 million in an all-equity round. The round was led by Round13 Digital Asset Fund, with participation from NVIDIA, CoreWeave, SBI, Web3.com, and others. CoreWeave and Nvidia are also providing access to computing power as part of their investments. Wombo’s consumer apps generate memes and illustrations based on users' selfies and text prompts. The company plans to use the funds to expand its team, accelerate product development and explore new frontiers in AI-powered content creation. FINSMES

Delta, B.C.-headquartered startup Uni-one raised $10 million in a Series A round to scale across Canada and the U.S. The round included investments from Celtic House Asia Partners and affiliate Celtic House Venture Partners, Red River Investments, Banyan Pacific Capital, Fantuan, and others. Uni-one offers a one-stop platform for restaurants, grocers, wholesalers and any business requiring food products. The app allows clients to browse products, receive recommendations, place and manage orders, track costs and trends, and more. Uni-one’s proprietary intelligent system integrates procurement, warehouse management, front-end order placing and logistic dispatching. The company plans to use the funds to extend its distribution services to all Canadian provinces and cities and also enter the U.S. market. Vancouver Tech Journal

Toronto-based New School Foods raised $8 million in a seed funding extension round to support the launch of the company’s plant-based salmon alternative in the U.S. and Canada. The round was led by Good Startup, with participation from returning investors NewTree Capital and Hatch, as well as new investor Inter IKEA Group. The company also received non-dilutive funding from Protein Industries Canada and angel investors. Founded in 2021 by Chris Bryson, New School Foods specializes in creating plant-based seafood designed to replicate the taste, texture and nutritional benefits of conventional seafood. The startup has developed proprietary “scaffolding and directional freezing” technologies to produce “whole-muscle” seafood alternatives, which closely mimic the structure and appearance of real fish. The new funding will help New School Foods expand its presence in North American restaurants, with a focus on the food service sector where 70 percent of U.S. seafood purchases occur. New School Foods also unveiled a 28,000-sq.-ft. pilot production facility in Toronto, which will house its commercial assembly line, research labs and business operations team. FoundersToday

Vancouver-based recycling startup ChopValue added $4 million to its Series A round, thanks to an investment from InBC Investment Corp. With InBC’s new equity investment, the funding round now totals $19 million, and the startup’s total funding now exceeds $30 million. Founded in 2016, ChopValue has created a system for recycling chopsticks from restaurants. The startup said it collects over 350,000 chopsticks a week from its network of restaurant partners to prevent them from ending up in a landfill. Once collected, the chopsticks are delivered to “micro-factories” that generate a composite material, made by pressing the discarded chopsticks together under high pressure along with a water-based resin. This material is then used in furniture and decorative items for homes and businesses. The startup sells these products directly on its website. ChopValue has more than 80 micro-factories in over nine countries, including in Canada, the U.S., Mexico, the Philippines, Malaysia, Singapore, and the U.K. The company is also opening its first micro-factory in Japan in the fall. BetaKit

Vancouver-based Raven Indigenous Capital Partners – North America’s only Indigenous-led and owned VC intermediary – invested $3.5 million in Edmonton-based Runwithit Synthetics (RWI), which specializes in 3D synthetic modelling, data visualization and digital twin technology. RWI said the new funds will allow the company to grow its team, add more products and expand regional access. Regions and cities are using the company’s digital models as “sandboxes” to explore the potential impact of natural or human-caused events. These scenarios could involve climate, sustainability, energy or public health challenges. To date, RWI has worked with 14 municipalities in Edmonton, Calgary, Los Angeles County, and Nashville. The company’s work has also won an award in the United Nation’s global call for innovative solutions for decarbonizing. Vancouver Tech Journal

Montreal-based startup Aplantex closed a $2.8 million funding round led by Aplantex board member Frederick Perrault, with participation of the Circular Innovation Fund, Cycle Momentum, Investissement Québec, and a number of angel investors. Aplantex specializes in extracting high-value plant molecules from plant biomass from proprietary photosynthetic plant replicators, and supplies these active ingredients to pharmaceutical, cosmetics, natural health and food additive companies. Aplantex said the funds will accelerate the development of the company’s strategic and production plan. BusinessWire

Toronto- and San Francisco-based C100 announced the 2024 cohorts for its new Growth Program (now in its 15th year) and its re-energized Fellows Program. These programs are designed to help Canadian technology companies accelerate growth by connecting them with the expertise, networks and resources of C100’s Silicon Valley, Toronto, and Global Membership. The Growth Program is designed to support rapidly scaling Canadian companies with $10 million+ in annual revenue. C-100 said the 12 companies in the cohort exemplify the best of innovation that Canada has to offer, with more than half of the leaders being serial entrepreneurs. The cohort comprises pioneers in business-to-business, software-as-a-service, fintech, health tech, cleantech, and AI. The 2024 Growth Program cohort companies include: 7gen, Arteria AI, ContactMonkey, e-Zinc, Humi, My01, Phoenix, Rebelstork, Relay Financial, RetiSpec, stan, and Uride. On average, these cohort companies will generate annual revenues of US$20 million in 2024, with many expected to surpass US$30 million. In the 2024 Fellows Program for early-stage startups, cohort companies include Ad Auris, Agentnoon, Blanka, Bounce, Cascade, CruxOCM, Cybrid, Endor Health, Friendlier, Hyper, Kento Health, MarineLabs, NiaHealth, Numr, Optimotive, GoVeyance, Rhenti, Rootd, Swap Robotics, Taiv, TeamLinkt, Tengiva, Ubenwa Health, Unified API, Youthfully, Zown. C100

Montreal-based fintech startup Hardbacon (Bacon Financial Technologies Inc.) has shut down and plans to file for bankruptcy after most of its Google traffic vanished following some updates to the search giant’s platform. Hardbacon offered a free budgeting app and generated revenue through lead generation and affiliate marketing for financial products. Julien Brault, who funded Hardbacon, said in a blog post that the company lost 97 percent of its traffic from Google after an update by the search giant in September 2023. Brault noted that a federal judge ruled in August that Google violated U.S. antitrust law with its search business and that the company is “a monopolist, and it has acted as one to maintain its monopoly.” A Google spokesperson told BetaKit that its updates weren’t designed to target pages with affiliate links, but to deprioritize content made solely for the purpose of ranking well on search engines and attracting clicks rather than helping people. Hardbacon

Calgary-based Network Innovations, a global technology integrator of critical communications and related services, announced it acquired Telesat’s Infosat Communications, a satellite services company focused on serving the remote business operations sector. Financial terms weren’t disclosed. The sale is subject to regulatory approvals. Network Innovations said Infosat Communications’ expertise complements that of Network Innovations, and will enhance the creation and delivery of reliable communication solutions and services to enterprise and maritime clients across North America. Network Innovations

Toronto-based Carbon6, a software platform for Amazon businesses, acquired Washington, D.C.-based Junglytics, an AI-powered business intelligence product designed to enhance data-driven decision-making for sellers. Financial terms weren’t disclosed. Carbon6 said this strategic acquisition strengthens its capabilities by integrating Junglytics' cutting-edge AI technology with Carbon6's data platform, offering sellers a game-changing tool for optimizing operations and maximizing profitability. The Junglytics platform and AI assistant provides real-time data analysis and actionable insights, all through a GPT-style conversational interface, simplifying how sellers interact with Amazon’s marketplace. BusinessWire

Texas-based health care services firm and pharmaceutical conglomerate McKesson Corporation has agreed to sell its Canada-based Rexall and Well.ca businesses to Birch Hill Equity Partners, a Toronto-based private equity firm. Financial terms weren’t disclosed. McKesson said the transaction enables the company to further focus and prioritize investments to grow its oncology and biopharma services platforms. Birch Hill said it intends to open new stores and expand services. Rexall, which competes with Shoppers Drug Mart-Loblaw, closed 40 stores in 2018 and has reportedly been on the market for months. Birch Hill’s holdings range from CCM hockey equipment to Citron Hygiene cleaning services to the private Yorkville University. McKesson Corporation

Miami, Florida-based public relations management company Muck Rack acquired Toronto-based social media analytics firm Keyhole. Financial terms weren’t disclosed. Muck Rack said the acquisition brings integrated social listening to its customers. Muck Rack plans to keep the Keyhole product up and running, so customers can easily access key insights into how their brand is perceived across social channels and help customers understand how social media and news coverage work together in the broader media ecosystem – all within the Muck Rack platform. Keyhole’s technology monitors direct and indirect brand mentions, hashtags, influencers and keywords across X (formerly Twitter), Facebook, Instagram, YouTube and TikTok. It also tracks social media analytics and sentiment analysis. Muck Rack

Quebec was the top Canadian province for venture capital investments in the first quarter of 2024, with 29 deals totalling $583 million – a 46-percent increase compared with the same period in 2023, according to a report by Montreal-based investment industry association Réseau Capital and its Centre of Expertise. Although the deal count reached its lowest level since 2016, investments reached their second-highest level for a first quarter since 2013, notably due to the performance of the life sciences sector which had seven deals totalling $309 million, the report says. In the first quarter, Quebec emerged as the best-performing Canadian province in private equity, with 77 deals totaling $2.94 billion. This period was marked by five deals exceeding $100 million, representing over 90 percent of the total value. The industrial and manufacturing sector accounted for more than 40 percent of the deals (31 deals for $131 million) completed during the quarter. The automotive and transportation sector led in terms of investment amounts (three deals for $1.23 billion). The average size of VC investments in Quebec was $20.09 million, the highest in Canada. In seed funding, with $21 million invested across 11 deals, deal count in the first quarter of 2024 was down 50 percent and dollars invested declined by 72 percent compared with the previous quarter (22 deals totaling $75 million). Réseau Capital

Six Canadian universities made Pitchbook’s Top 100 list of post-secondary institutions that have produced the most founders at the undergraduate level. The University of Waterloo topped the list of Canadian universities and ranked 21st globally for the third year in a row. McGill University and the University of Toronto followed, ranking 23rd and 25th, respectively. The University of British Columbia made the top 50, coming in the 43rd spot, while Queen’s University landed at 69th. Western University was ranked No. 96. PitchBook ranked universities based on the number of founders it produced and companies that secured a round of venture financing between January 1, 2013 and August. 1, 2024. In the past decade, UWaterloo has educated 562 founders who have collectively raised US$20 billion. McGill University produced 558 founders that have collectively raised US$19.9 billion over the same timeframe. In the third spot with 531 founders among Canadian universities, U of T alumni have collectively raised the most capital at US$26.3 billion. UBC has 367 alumni who went on to start companies that collectively raised US$5.6 billion. Queen’s University has produced 272 founders over the past decade, raising a collective US$8.3 billion. Western’s 194 alumni together have raised US$2.4 billion. In a separate report by London, U.K.-based Immerse Education, McGill University, Queen’s University and Western University were the top three Canadian universities for producing the most chief executive officers. (See item under “Research, Tech News & Collaboration” in the August 7, 2024 Short Report). BetaKit

REPORTS & POLICIES

Canada’s labour productivity declined in second quarter of this year

Labour productivity of Canadian businesses declined 0.2 percent in the second quarter this year, after posting a similar decline (0.3 percent) in the previous quarter and a 0.3-percent increase in the fourth quarter of 2023, according to Statistics Canada.

In the second quarter of 2024, business output and hours worked both increased at a slightly faster pace than in the previous quarter, StatsCan said in a report.

However, growth of output was slightly lower than that of hours worked, resulting in a moderate decline in productivity in the second quarter.

Overall, productivity was down in 11 of the Canada’s 16 main industry sectors, StatsCan said.

Labour productivity is a measure that calculates economic output per unit of labour required to produce it. Labour productivity is an important factor in calculating overall, or “total factor productivity.”

Carolyn Rogers, senior deputy governor of the Bank of Canada, described in April Canada’s ongoing decline in productivity as an “emergency – it’s time to break the glass.”

Canada has fallen from the 6th most productive economy among Organisation for Economic Co-operation and Development countries in 1970 to the 18th as of 2022.

Canada is 30 percent less productive than the U.S., and closer to lower-income states like Alabama in terms of economic performance than tech-rich California or New York.

U.S. labour productivity growth was 160 percent faster than Canada’s from 2002 to 2020 – and America’s growth in that period was actually low in historical terms. (See “Solving Canada’s Productivity Crisis” in the August 2, 2024 Short Report).

According to the new Statistics Canada report, real gross domestic product of businesses rose 0.5 percent in the second quarter of 2024, following a 0.2-percent increase in the previous quarter. This was the highest quarterly growth rate since the first quarter of 2023 (+0.9%).

In the second quarter of 2024, growth in hours worked in the business sector, which had reached 0.4 percent in the previous quarter, accelerated slightly to 0.6 percent.

This slightly faster pace of growth in hours worked reflects the 0.7-percent increase in the number of jobs in the second quarter, while average hours worked (-0.1 percent) were virtually stable.

In the second quarter of 2024, hours worked increased in both service-producing businesses (+0.8 percent) and goods-producing businesses (+0.3 percent), as the increase was widespread in all main industry sectors.

The accommodation and food services (-0.6 percent), retail trade (-0.2 percent) and manufacturing (-0.1 percent) sectors posted declines, albeit moderate, while hours worked in administrative services were essentially unchanged.

In the second quarter of 2024, the productivity decline in the business sector was mainly attributable to service-producing businesses, which recorded a 0.3 percent decrease. This was largely due to declines in most service sectors, notably information and cultural industries (-2.1 percent), real estate services (-1.5 percent) and professional services (-0.9 percent).

For goods-producing businesses, productivity edged up by 0.1 percent in the second quarter, due to an increase in the mining and oil and gas extraction sector (+1.8 percent), which more than offset the decreases observed in the other goods sectors.

With the 0.2-percent decrease in productivity, a 0.6-percent growth in hourly compensation resulted in a 0.8-percent rise in unit labour costs of businesses in the second quarter of 2024.

This represents a slowdown compared with the 1.3-percent increase recorded in the first quarter. The slower pace of growth in hourly compensation (+0.6 percent) compared with the previous quarter (+1.0 percent) was the main factor contributing to the slowdown.

Unit labour costs represent the costs of wages and benefits per unit of output.

Another important indictor of overall productivity is Canada’s per-capita GDP – a broad measure of incomes, and consequently of living standards.

Canada’s GDP per capita is currently below the level in the second quarter of 2019, according to a study by the Fraser Institute.

If Canada’s per-capital GDP doesn’t recover this year, the decline since mid-2019 may be the longest and largest decline in per-person GDP over the last four decades, the study said. (See the item under “Reports & Policies” in the June 5, 2024 Short Report). StatsCan

******************************************************************************************************************************

Ottawa setting up working group to examine productivity

The Government of Canada announced it’s setting up a working group to examine productivity and inform the government’s economic plan.

Anita Anand, president of the Treasury Board, will immediately set up the working group, which will address barriers to achieving greater efficiencies for businesses so government can help increase productivity across the country, Ottawa said.

Anand told reporters her working group will look at labour efficiency trends in both the public and private sector productivity, and propose recommendations to address productivity concerns.

A spokesperson for Anand said the working group’s membership had not been determined, but would be comprised of “public and private sector representatives, academics and union members.”

The working group is expected to officially launch later this fall, with a goal of delivering recommendations by next spring.

As announced in Budget 2024, the federal government said it will continue its efforts to enable innovation and reduce red tape by introducing amendments to the Red Tape Reduction Act to broaden the use of regulatory sandboxes and continue advancing Bill S-6 through Parliament.

In addition, Anand and Dominic LeBlanc, minister of Public Safety, Democratic Institutions and Intergovernmental Affairs, are taking steps to remove barriers to interprovincial trade, the government said.

On September 26, Anand and LeBlanc will be meeting with federal, provincial and territorial (FPT) ministers of the Committee on Internal Trade to continue working with governments to decrease the costs of goods and services for Canadians and allow the freer movement of labour in this country.

“This will kick off a stronger and swifter approach with FPT ministers to support interprovincial trade and reduce red tape,” Ottawa said.

Anand noted that the federal government committed more than $2 billion in Budget 2024 for artificial intelligence, “and in particular for [innovation] sandboxes and startups. That is one way in which we are seeking to address the issue of productivity, to ensure that businesses can become more efficient.”

Vivek Dehejia, an economics professor at Carleton University, told iPolitics that Canada’s woeful productivity trends are rooted in unfavourable market structures that limit competition and discourage internal investment.

As an example, he pointed to the telecommunications and grocery retail sectors, both of which are dominated by a handful of large firms. “Across the board, we have a high degree of concentration and we essentially have oligopolies in most major industries, and that kills productivity growth.”

Dehejia said low productivity in Canada’s public sector is similarly explainable, as the federal government essentially holds a monopoly in everything it does.

“We know the causes of this problem,” he said. “As for [the government’s] proposed solution to create a working group to investigate it, I find that quite laughable.”

“I actually find it quite sad that they feel the need to create a working group on something that I teach my first-year students.” Govt. of Canada, iPolitics

******************************************************************************************************************************

Canadian business R&D spending continues to increase but is still half of the average spent by OECD countries

Businesses in Canada continued their upward trend in research and development spending in 2022, reaching new heights and building on the steady increase that began in 2016, Statistics Canada (StatsCan) reported.

All told, Canadian businesses spent a record $30.4 billion on in-house R&D in 2022, an increase of 9.4 percent from 2021, according to a new report by StatsCan.

Canada’s business sector has historically conducted more than half of all R&D activities in the country, rising to nearly 60 percent in recent years.

Despite recent spending increases, however, Canadian business enterprise R&D expenditure remained around one per cent of gross domestic product, StatsCan said. This is half the Organisation for Economic Co-operation and Development average for businesses from reporting member countries, according to the OECD’s most recent data for 2022.

StatsCan said preliminary data for 2023 indicate that in-house R&D spending by Canada’s business sector will continue to rise, albeit at a slower pace with spending increasing by 3.4 percent (+$1.0 billion) to a projected $31.4 billion – two years after record year-over-year growth from 2020 to 2021 (+17.3%).

Despite the slowdown expected in 2023, businesses are optimistic for 2024 with indications that R&D spending intentions will increase by $1.5 billion (+4.8 percent) to reach $32.9 billion.

Of the $30.4 billion spent on total in-house R&D in 2022, the vast majority (95.2 percent) was allocated to current in-house expenditures ($28.9 billion), with the balance going to capital investments ($1.5 billion).

Current in-house expenditures include wages and salaries, services to support R&D, R&D materials and other related costs.

Wages and salaries make up the largest part of these expenditures, accounting for $20.7 billion in 2022. While wages have always been the largest single expense for performers of R&D, their share of the total cost has been increasing over the past decade.

In 2014, for example, wages accounted for 61.8 percent of current in-house expenditures (57.4 percent of total in-house expenditures), but have since increased to 71.5 percent (68.1 percent of total in-house expenditures) in 2022.

“The significant allocation of resources towards R&D personnel is expected, as R&D activities are predominantly knowledge-based,” StatsCan said. These activities require highly educated and qualified experts to conduct experiments, manage projects, provide technical and scientific advice, and support operations.

The importance of R&D personnel is also underscored by the increase in their numbers from 2014 to 2022. During this time, the number of R&D personnel in the business sector rose from around 154,000 full-time equivalents (FTEs) to around 212,000 FTEs, a compound annual growth rate of four percent.

Following a rebound in 2021, outsourced R&D expenditures remained steady in 2022 at $5.8 billion. This spending is in stark contrast to the declines noted in 2019 (-$423 million) and 2020 (-$55 million), and is the result of increased outsourcing to both Canadian (+$754 million) and foreign (+$474 million) R&D performers in 2021 which remained relatively constant in 2022 (-$47 million to Canadian performers; +$11 million to foreign performers).

Preliminary data for 2023 and company intentions for 2024 suggest that the current level of expenditure is expected to be maintained, which highlights the importance of external collaborations in advancing R&D activities.

Despite the overall total numbers remaining steady, there is an expected shift in the location where outsourced R&D is performed. Whereas in 2022 expenditures to Canadian recipients accounted for 68.1 percent of all outsourced expenditures, indications suggest that this rate will drop to 61.5 percent in 2024.

As for spending by various sectors, R&D expenditures for medical biotechnology – the largest emerging field of R&D in terms of expenditures made by businesses in Canada – have increased from $561 million in 2019 to $1.2 billion in 2022, pushed up in part due to the COVID-19 pandemic.

Agricultural biotechnology is second only to medical biotechnology as the largest emerging biotechnology. Agri-biotech has maintained a relatively stable state since 2018 when R&D expenditures reached $130 million. In 2022, they decreased to $123 million.

Nanotechnology experienced fast growth in 2020, jumping from R&D expenditures of $64 million in 2019 to $99 million in 2020. Nanotech R&D expenditures decreased from 2021 to $79 million in 2022, though they remain above 2019 levels.

Expenditures tied to industrial biotechnology have varied in recent years, with both 2018 and 2019 coming in at around $50 million, and decreasing in the next two years before reaching $66 million in 2022.

The smallest of the emerging biotechnologies in terms of R&D expenditures is environmental biotechnology. Expenditures ranged from $44 million to $48 million from 2016 to 2019, declining to a low of $17 million in 2021, before rising to $24 million in 2022 – well below the historic high in 2017. StatsCan

******************************************************************************************************************************

Parliamentary standing committee wants new audit of Sustainable Development Technology Canada

The House of Commons Standing Committee on Public Accounts wants Canada’s auditor general to do another, more exhaustive audit of cleantech grants given out by Sustainable Development Technology Canada (SDTC) in the last seven years.

On September 3, members of the Committee approved a Conservative motion calling on Auditor General Karen Hogan to conduct a “value for money and performance” audit on work done by SDTC since January 1, 2017.

The call for the second audit into what the Conservatives have called the “green slush fund” comes three months after Hogan published a scathing report on SDTC.

Her report found that 10 of the 58 projects funded by STDC that her office audited were ineligible and yet had still received a total of $59 million.

Hogan also found serious governance issues, such as 90 funding approval decisions representing nearly $76 million in which there was an apparent conflict of interest by a voting member. The ethics commissioner later found the cleantech fund’s former board chair, Annette Verschuren, had contravened federal conflict-of-interest rules.

The same day Hogan’s audit was published, Innovation Minister François-Philippe Champagne announced he was shutting down SDTC as an independent agency and folding its responsibilities into the National Research Council within one year.

Conservative MP Rick Perkins argued that Hogan’s report only “scratched the surface” by auditing a selection of projects, and he tabled a motion asking her to go back and do a more comprehensive “value for money” audit of all the funding agreements signed by SDTC since 2017.

In a statement, Office of the Auditor General spokesperson Sébastien Bois said the office would review the committee’s request but didn’t commit to a second audit of SDTC.

The National Post reported that on June 10, the House of Commons passed a Conservative motion ordering the government and SDTC to provide a trove of documents on SDTC to the House of Commons law clerk, Michel Bédard.

The order requires the same of the Office of the Attorney General, in addition to “any other document” Hogan used to prepare her audit of SDTC.

The motion, supported by opposition parties but opposed by the governing Liberals, ordered the Commons law clerk to turn over those documents to the RCMP.

On July 10, Hogan wrote House of Commons Clerk Eric Janse to inform him she would not comply with the order because the records she audited don’t belong to her office but to the government. Turning over the documents could compromise her office’s work and its independence, she said.

Hogan also said that she did not find any potentially criminal activities during her audit of SDTC that warranted notifying the police. National Post.

******************************************************************************************************************************

Canadian universities reporting decline in international students, amid protests over federal and Quebec policies

Several Canadian universities are reporting declines in the number of international students applications and, for Quebec, also Canadian students from outside the province.

In Manitoba, the University of Manitoba, University of Winnipeg, Brandon University, and Red River College Polytechnic are among those reporting a decline in the number of international students on their campuses.

The number of new international students enrolled at the University of Manitoba, the province’s largest post-secondary institution, decreased from 1,951 students to 1,366 students, according to the university’s preliminary fall enrolment report.

The University of Winnipeg is estimating approximately 122 fewer first-year students from abroad, an 18-percent drop compared with fall 2023.

The university's early estimate pegs the financial loss at $4 million this fiscal year, which will reduce overall tuition revenue by five percent, according to CBC News.

The University of Winnipeg estimates its professional, applied and continuing education programs, as well as its English language programs, will face a 30-percent to 35-percent drop in international enrolment, or around 106 students, year-over-year.

Assiniboine College, Canadian Mennonite University, and the Université de Sainte-Boniface have experienced slight increases in their international student numbers this fall.

Université Laval and Bishop’s University in Quebec are reporting a decline in international students.

Contacts from ULaval and Bishop’s attributed their decline to the confusion created by recent policy changes at both the federal and provincial levels.

The federal government earlier this year capped the number of international study permits for two years, while the Quebec government substantially raised tuition for international students.

Bishop's expects a decline of up to 40 percent in international students.

Universities Canada says enrolment by students from outside Canada has fallen below the cap the federal government set on international student study permits this year, according to a report by The Canadian Press.

Universities Canada president Gabriel Miller said the change in international student numbers will actually be bigger than the government predicted, and it will take a major financial toll on schools.

Miller said the cap created uncertainty for prospective students, and the federal Immigration Department’s pause in visa processing while the government implemented the cap may have led those students to look elsewhere.

Concordia University and McGill University are reporting a decline in undergraduate applications from out-of-province students, according to the Toronto Star.

Concordia has seen a 28-percent decrease in applications from Canadian students from outside of Quebec compared with last year, while McGill has experienced a 15-percent drop.

Both institutions have also reported a decline in applications from international students, though they are seeing a slight uptick in applications from within Quebec.

This decreased interest in the two anglophone universities comes in the wake of the Quebec government’s decision last year to raise tuition for out-of-province students to a minimum of $12,000.

Meanwhile, there were Canada-wide protests at the end of August, as more than 70,000 international student graduates could face deportation due to federal policy changes, City News reported.

Representatives with Naujawan Support Network, a student advocacy group, said the graduates are at risk of being deported when their work permits expire at the end of this year.

Thousands of students who had planned to apply for permanent residency after completing their studies say they are now left with heavy loans and shattered dreams, according to the City News report.

The students and their supporters are urging the government to extend post-graduate work permits, provide consistent and transparent pathways to permanent residency, and address the systemic issues that have led to their exploitation. CBC, Le Journal de Montréal, Toronto Star, City News

******************************************************************************************************************************

Repeal “greenwashing” new rules in Competition Act or provide clear guidance on how they apply, says Canadian Association of Petroleum Producers

The federal government’s amendments to Canada’s Competition Act to prevent “greenwashing” should be repealed and time taken to have a fulsome discussion on the issue of greenwashing, says the Canadian Association of Petroleum Producers (CAPP).

Failing that, the government should ensure the new rules are applied equally across all industries and sectors and provide guidance on how they will be applied, the Calgary-based industry association says in a submission to the Competition Bureau.

“In order to clarify when the Competition Bureau will challenge an environmental claim (i.e., the risk that companies operating within certain industries and sectors will become automatic targets), the Competition Bureau should explicitly state that all businesses, not-for-profits, and advocacy groups will be held to the same standards.”

CAPP says it remains opposed to the Competition Act’s amendments and believes they should be appealed.

“Implementing a vague law with exceptionally high penalties, with no consultation, and which has an outsized impact on the country’s largest industries is both anti-democratic and anti-business,” CAPP says.

“The effect of this legislation is to silence the energy industry, and those that support it, in an effort to clear the field of debate and promote the voices of those most opposed to Canada’s energy industry.”

Without clear guidance as to how the Competition Bureau plans to handle frivolous and vexatious claims, the new rules will have a chilling effect on companies’ disclosure and participation in climate and environmental policy discussions, CAPP says.

The Competition Act amendments hamper business’ ability to gain public support for their projects and products and will therefore serve to drive investment away from Canada and into other jurisdictions, including investment in projects and technologies aimed at lowering emissions, the industry association argues.

Under the new greenwashing provisions, environmental representations do not need to be false or materially misleading to be actionable, CAPP notes. They can be true but still violate the new provisions unless they can be substantiated in accordance with "internationally recognized methodology."

Guidance is required for business to assess whether an international methodology is "internationally recognized" for purposes of complying with the Competition Act, CAPP says. “Specifically, the Competition Bureau should clarify what criteria businesses should apply as existing international methodologies are modified, or new international methodologies are published.”

The guidance should be clear that the new rules only apply to public statements made with respect to the environmental benefits of a business or business activity, and do not apply to communications generated for other purposes (e.g. to meet regulatory requirements, communicate with Indigenous groups, commercial partners or other parties, complete funding applications and other types of applications, etc.), CAPP says.

“Private companies, as well as small, junior and large established reporting issuers alike, should be able to talk about their environmental ambitions without fear of reprisal under the Competition Act.”

CAPP points out that some companies use scenario analysis to create hypothetical constructs about the future. Scenarios are not aspirational statements, and disclosures related to scenario analysis should not be viewed as representations that are subject to the new greenwashing provisions, the industry association says.

Industry has long participated in public policy discussions about climate change and protection of the environment, and contributed to such discussions in a meaningful way, CAPP says. “Not only have the changes to the Competition Act already severely limited industry's ability to provide much of this information and cut off their participation in this crucial public discussion, but they have limited companies’ ability to communicate important information to their shareholders, Indigenous partners, and other stakeholders.” CAPP

THE GRAPEVINE – News about people, institutions and communities

Mark Carney, former governor of the Bank of Canada and the Bank of England, will chair the federal Liberal Party’s Leader’s Task Force on Economic Growth. The globally acclaimed Canadian economist, public policy leader, sustainability advocate and author will develop new ideas for the next phase of Canada’s strategy for near- and longer-term economic growth and productivity, and help the party shape a pragmatic, focused and high-impact vision for Canada’s economic success, the Liberal Party of Canada said in making the announcement from the federal government's caucus meeting in Nanaimo, B.C. The task force will hold meetings and events to hear ideas from Canadians in the weeks and months ahead, including foremost experts in the business community, labour movement, Indigenous economic leadership, innovators, and more, the Liberals said. Recommendations will be shared in a report with Liberal Party leader and Prime Minister Justin Trudeau and Liberal Party’s Platform Committee, as the party prepares for the next election. Liberal Party of Canada