The Short Report: October 30, 2024

GOVERNMENT FUNDING

The Government of Canada launched two key two key parts of its $2.4-billion AI package – committed to in Budget 2024 – to ensure the economic benefits of artificial intelligence reach all corners of the country. Through the new $200-million Regional Artificial Intelligence Initiative, Canada’s Regional Development Agencies will support AI startups to bring new technologies to market and drive AI adoption by small businesses in critical sectors across the economy, such as agriculture, clean technology, health care and manufacturing. Companies can receive up to $5 million and must repay the funding, but won’t be charged interest. In addition, the National Research Council of Canada’s (NRC) Industrial Research Assistance Program is receiving $100 million to help small and medium-sized businesses scale up and increase productivity by building and deploying new AI solutions. Companies can apply to the NRC for R&D funding. The government’s $2.4-billion AI package also included $2 billion to build and provide access to computing capabilities and technological infrastructure for Canada’s world-leading AI researchers, startups, and scale-ups. The package also included $50 million for the Sectoral Workforce Solutions Program, which will provide new skills training for workers in potentially disrupted sectors and communities. In addition, the package included creating a new Canadian AI Safety Institute, with $50 million to further the safe development and deployment of AI. However, no announcements were made to move forward on any of these other components of the AI package. Govt. of Canada

The Government of Canada launched two key two key parts of its $2.4-billion AI package – committed to in Budget 2024 – to ensure the economic benefits of artificial intelligence reach all corners of the country. Through the new $200-million Regional Artificial Intelligence Initiative, Canada’s Regional Development Agencies will support AI startups to bring new technologies to market and drive AI adoption by small businesses in critical sectors across the economy, such as agriculture, clean technology, health care and manufacturing. Companies can receive up to $5 million and must repay the funding, but won’t be charged interest. In addition, the National Research Council of Canada’s (NRC) Industrial Research Assistance Program is receiving $100 million to help small and medium-sized businesses scale up and increase productivity by building and deploying new AI solutions. Companies can apply to the NRC for R&D funding. The government’s $2.4-billion AI package also included $2 billion to build and provide access to computing capabilities and technological infrastructure for Canada’s world-leading AI researchers, startups, and scale-ups. The package also included $50 million for the Sectoral Workforce Solutions Program, which will provide new skills training for workers in potentially disrupted sectors and communities. In addition, the package included creating a new Canadian AI Safety Institute, with $50 million to further the safe development and deployment of AI. However, no announcements were made to move forward on any of these other components of the AI package. Govt. of Canada

Pacific Economic Development Canada (PacifiCan) announced that businesses and not-for-profit organizations will be able to apply for funding from the new Regional Artificial Intelligence Initiative (RAII) in British Columbia beginning November 18. In B.C., PacifiCan will deliver the RAII with $32.2 million over the next five years, making investments that help businesses commercialize and adopt AI technologies. PacifiCan will prioritize projects that not only have strong economic benefits but also bring positive outcomes for human health, the environment and/or economic resilience and productivity across a wide range of sectors. PacifiCan will welcome project ideas from both businesses and not-for-profit organizations. More information is available on PacifiCan’s web page. PacifiCan

Transport Canada announced up to $22.5 million for Nova Scotia-based EverWind Fuels. This funding, provided under the Green Shipping Corridor Program, will allow the company to:

- purchase a loading arm to fuel and fill ships with green ammonia.

- build a pipeline to transport green ammonia from the production facility to the transport terminal.

- buy three tugboats and improve the dock to help move and load ships safely.

Investments through the Green Shipping Corridor Program decarbonize the marine sector and encourage ports to adopt clean energy, while preparing them to support exports of clean fuels like ammonia. EverWind is developing a large-scale green hydrogen project in Point Tupper, N.S., that will convert wind energy into green hydrogen and green ammonia. Transport Canada

Prairies Economic Development Canada (PrairiesCan) announced a federal investment of $15 million for NFI Group to expand operations and fully manufacture New Flyer transit buses in Winnipeg, Man. This investment will enable NFI Group to competitively respond to growing demand for Canadian-made zero-emission transit buses, adding hundreds of skilled jobs to the company’s Canadian operations with more opportunities for local suppliers, and growing Manitoba’s role in the green Prairie economy. The funding will ensure NFI Group can meet Canadian standards and will support the development of workforce training specific to zero-emission vehicle manufacturing, including a proposed “Zero-Emission Pre-Apprenticeship Program.” PrairiesCan

The Canadian Institutes of Health Research (CIHR) announced two dozen research projects funded by more than $13.7 million under the National Women’s Health Research Initiative (NWHRI). The joint initiative, between the CIHR and Women and Gender Equality Canada, was announced as part of the 2021 federal budget to advance a coordinated research program that addresses under-researched and high-priority areas of women's health and to ensure new evidence improves women's, girls’, and gender-diverse people's care and health outcomes. Through the NWHRI, 24 research projects were funded in the following areas: polycystic ovary syndrome, rural and Indigenous perinatal care and breastfeeding, heart health, gender-based violence, mental health, eating disorders, reproductive care and pregnancy, cancer and human papillomavirus, vestibulodynia (chronic vaginal pain) and endometriosis, and many more high-priority health areas. CIHR

Pacific Economic Development Agency (PacifiCan) announced $9.4 million to help three Surrey, B.C.-based businesses grow locally and compete globally. Nanak Foods Inc., an innovative food manufacturer, is receiving $5 million. Nanak is North America’s largest and leading manufacturer of specialty dairy-based, South Asian-inspired foods. The investment will allow the company to increase production of paneer cheese by expanding its operations with new equipment. Dr. Ma's Laboratories, a natural health product manufacturer, is receiving over $3.1 million to scale up operations and create new jobs. LED Smart is receiving over $1.2 million to continue to innovate in the design of its horticulture lighting system and increase production to meet global demand. PacifiCan

Agriculture and Agri-Food Canada (AAFC) announced the Government of Canada and the Government of Ontario are investing up to $7.5 million to support 365 projects that will help the province's farmers, food processors and essential farm-supporting agribusinesses protect their operations against pests and diseases while enhancing operational resilience and strengthening public trust in our food supply system. The funding, through the Biosecurity Enhancement Initiative, combined with cost-shared investments by the sector, is expected to generate up to $31.5 million in total biosecurity enhancements across Ontario's agri-food sector. Under the initiative, farmers, processors and select farm-supporting agri-food businesses are eligible for cost-share funding ranging from 35 percent to 50 percent, depending on the project category. Supported activities include the implementation of technologies that reduce the spread of animal and plant diseases and capital upgrades that enhance biosecurity (such as constructing isolation facilities and wash bays). Examples of projects include:

- Up to $50,000 for a sheep farm in Clarington to build a new barn to improve its on-farm isolation and separation processes.

- Up to $50,000 for an Ottawa-area farm to purchase and implement an electronic traceability collection system to improve biosecurity and animal health for its cattle farming operation.

- Up to $29,353 for a berry farm in Niagara Region for a steam treatment system to eliminate damaging pests and diseases. AAFC

The Atlantic Canada Opportunities Agency (ACOA) announced total federal contributions of more than $6 million to help seven small and medium-sized businesses scale up and modernize their operations. The funding will help Farnell Packaging Incorporated, Ring Rescue Incorporated, Sunrise Foods Incorporated, Sunsel Systems Manufacturing Corporation, Ace Machining Limited, HFX Steel Framing Solutions Inc., and Aurea Technologies Inc. adopt technology, increase productivity and explore new markets. The largest contribution of $3 million will enable Dartmouth, N.S.-based Farnell Packaging Incorporated to purchase and install automated processing and printing equipment to support its expansion plans. ACOA

Natural Resources Canada (NRCan) announced a federal investment totalling $4.3 million for five projects , funded under the Greener Neighbourhoods Pilot Program and the Energy Innovation Program, to support and inform deep energy retrofits. EnviroCentre received over $2 million from NRCan’s programs for its project, which will develop the local building sector’s capacity to perform deep retrofits faster, saving time and money for retrofits in social housing across eastern Ontario. A deep energy retrofit is an extensive overhaul of a building’s systems that can generate large savings in energy costs, improve comfort and help decarbonize buildings. Retrofits through the federally funded project will include:

- replacement of traditional furnaces with electric heat pumps.

- upgrades to attic insulation and air sealing.

- installation of new heat recovery ventilation systems to improve indoor air quality.

Other projects announced included:

- $1 million for ReCover Initiative to develop a practical approach to deep energy retrofits for the most common types of residential buildings in Atlantic Canada.

- $1 million for the First Nations Power Authority of Saskatchewan to support the adoption of community-scale deep energy retrofits in Indigenous communities.

- $602,836 for Sustainable Buildings Canada to accelerate deep energy retrofits for Ontario's social housing.

- $775,897 for Retrofit Canada Society for development of a National Retrofit Repository of case studies and solutions to inform on deep energy retrofits across Canada. NRCan

The Canadian Space Agency (CSA) is investing an additional $1 million in lunar rover technologies developed by Bolton, Ont.-based Canadensys and Brampton, Ont.-based MDA Space. In December 2023, $2.9 million in funding was awarded to advance technologies focused on several fundamental fields for lunar exploration. These activities could prove key to the development of the future Canadian utility rover. Set to launch no earlier than 2033, this multi-purpose rover is being designed to tackle a range of tasks on the Moon's surface, from transporting equipment and conducting scientific investigations to supporting astronauts during spacewalks – all while enduring the extreme conditions of the lunar environment. CSA

The Public Health Agency of Canada (PHAC) announced research grants totalling $752,00 for projects by four organizations through PHAC’s Transmission Dynamics of Respiratory Infectious Diseases Research Funding Opportunity. Queen’s University, Carleton University, the Ontario Agency for Health Protection and Promotion, and the University of Waterloo will receive funding to work on individual projects investigating the transmission dynamics of respiratory infectious diseases. PHAC said these projects will help expand understanding of respiratory infectious diseases and inform advice for people in Canada on effective measures to prevent their spread. This information will also help prepare for future pandemic planning and response. PHAC

The Canadian Space Agency (CSA) awarded contracts valued at a total of $600,000 to four Canadian companies to design the next generation of prototypes for the Connected Care Medical Module (C2M2 ) Baüne (Edmonton), Lunar Medical (Toronto), CardioComm Solutions (North York, Ont.), and ResusMind (Montreal) each received approximately $150,000 for the design phase, of which up to three companies would proceed with the development of a prototype that could transform healthcare delivery in space and in remote areas of Canada. The C2M2 features an AI-supported computer system that integrates various medical technologies to address specific health needs. It enables the remote detection, diagnosis, treatment and monitoring of certain health conditions – crucial for future space missions to the Moon and Mars, during which astronauts will have to be more self-reliant. These same technologies could benefit Canadians living in remote and northern communities, where access to medical care can be limited or difficult. CSA

RESEARCH, TECH NEWS & COLLABORATION

Address Canada’s productivity problem by investing in the natural resources sector: Canadian Chamber of Commerce

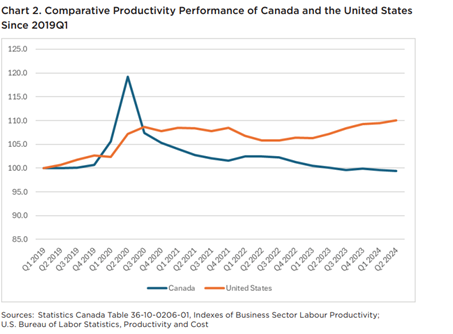

Canada’s productivity problem can be addressed by a renewed focus on enabling and investing in Canada’s natural resources sector, according to a report by the Canadian Chamber of Commerce.

The report, Canada’s Natural Wealth: Highlighting Canada’s strong natural resources sector, assessing the economic challenges, and identifying growth opportunities, provides recommendations to address Canada’s place as one of the least productive G7 nations, with the country facing significant economic challenges, low productivity, declining living standards, regulatory uncertainty and weak business investment.

“The natural resources sector is a significant part of the Canadian economy, with benefits being felt by other sectors throughout the supply chain. It’s the second-largest sector, and in 2023, paid annual compensation nearly $25,000 above the average,” Andrew DiCapua, senior economist with the Chamber of Commerce’s Business Data Lab and the report’s lead author, said in a statement.

“The sector can do this because of its productivity prowess, which is closely linked to the country’s prosperity and long-term standard of living. This is why increasing investment in high-productivity sectors, particularly within natural resources, is an obvious remedy to our productivity challenges.”

Highlights of the report’s findings include:

- Economic powerhouse: Canada's natural resources sector contributed $464 billion to real GDP and supported 3 million jobs in 2023, representing 21 percent of the national GDP and 15 percent of employment. Within the natural resources sector, mining, oil and gas, and pipeline transmission represent 45 percent of all GDP impact coming from the sector.

- Exports and trade balance: The sector generated $377 billion in exports, accounting for nearly 50 percent of Canada’s merchandise exports, and a $228 billion trade surplus – critical for offsetting trade deficits in other sectors.

- Job creation and productivity: The natural resources sector accounts for nearly one in seven jobs in the economy, offering annual wages $25,000 above the national average in 2023. The sector’s productivity is 2.5 times greater than that of the overall economy.

- Regulatory challenges: Regulatory uncertainty and underinvestment are impeding growth, with a growing share of firms citing taxes and regulations as a top concern for their business. Investment is reportedly being concentrated on repairs rather than expansion.

- Opportunities for growth: Increasing investment in high-productivity sectors, particularly within natural resources, is crucial for boosting Canada's economic well-being and advancing economic reconciliation with Indigenous communities.

According to the report, the Indigenous community in Canada earns almost three times more in wages working in the oil and gas extraction sector than the average Indigenous worker ($140,400 vs $51,120), almost twice as much working in mining ($93,600), and above-average in forestry ($56,100).

Deloitte estimates increased labour participation from underrepresented talent, such as Indigenous peoples, would increase average real GDP growth by 0.8 percent.

The report underscores an urgent need to develop a national strategy that promotes the sustainable development and export of Canada’s natural resources, ensuring alignment with environmental goals while maximizing economic benefits.

The report makes nine policy recommendations:

- Adopt a comprehensive Canadian natural resources strategy: Develop a national strategy that prioritizes and promotes the sustainable development and export of Canada’s natural resources, ensuring alignment with environmental goals while maximizing economic benefits.

- Accelerate economic reconciliation with Indigenous communities: Continue to encourage partnerships with Indigenous communities to advance key energy and critical mineral projects in support of economic reconciliation. This approach should include financial incentives (for both corporations and Indigenous groups) to encourage equity participation, access to financing, streamlined regulatory processes, co-administration agreements, and capacity-building to ensure long-term success, stewardship and shared prosperity.

- Prioritize efficient, timely and predictable regulatory approval processes: Canada must enhance its regulatory framework by streamlining approval processes to be more efficient, timely and predictable. For the Impact Assessment Act specifically, this includes minimizing approval processes and timelines, deferring to provincial regulators where appropriate, eliminating political interference in regulatory decision-making, and ensuring the scope of jurisdiction of the Act is clear and constitutionally sound.

- Promoting policy stability: An unstable and rapidly evolving policy environment gives rise to uncertainty and incremental cost pressures that discourage industry investment. The sheer number of environmental/economic policy reforms with potentially negative impacts being considered and advanced by the federal government has made investing in Canada a riskier and more costly proposition. Key examples include increases to federal industrial carbon pricing and stringency, the Clean Fuel Regulations, extended timelines for developing investment tax credits (ITCs), proposed Clean Electricity Regulations, and the proposed federal emissions cap and methane regulations.

- Expedite delivery and practicality of investment tax credits: Accelerate the delivery of the full suite of ITCs, to support major decarbonization, clean technology, mining and manufacturing projects, while extending eligibility timelines. Canada must make these incentives clear, accessible and swiftly actionable to remain competitive with the U.S. and other leading economies. The timelines for accessing the full value of the ITCs should be extended, with further flexibility built in to accommodate unanticipated and uncontrolled delays that may arise due to labour shortages or supply chain constraints.

- Prioritize the economic competitiveness of Canada’s natural resources industry. Our natural resource industries compete on a global scale, and Canada’s tax and fiscal policies need to be competitive with those of our major trading partners. In particular, the federal government should ensure its clean technology incentives, taxation policies and carbon pricing framework are comparable with those of the U.S., and do not unnecessarily expose industry to trade barriers or create disincentives for investment.

- Commit to long-term investment through a Canada trade infrastructure plan: Develop a Canada trade infrastructure plan to ensure long-term investment in infrastructure required for the efficient and reliable import and export of goods.

- Strengthen global trade relationships: Diversify Canada’s resource export markets by negotiating new trade agreements and reinforcing existing ones, particularly with emerging economies, to reduce dependency on a few markets and increase economic resilience.

- Promote public awareness and support for resource development: Launch a national campaign to educate the public on the importance of the natural resources sector, highlighting its role in Canada’s economy, energy security and technological innovation while countering misinformation. Canadian Chamber of Commerce

*****************************************************************************************************************************

B.C.-based Photonic Inc. and TELUS announced a collaboration to accelerate development of next-generation quantum communications in Canada. “This collaboration with TELUS allows us to move from the lab into real-world applications, showcasing the compatibility of our technology with existing infrastructure,” Dr. Stephanie Simmons, founder and chief quantum officer at Photonic, said in a statement. “It marks a significant step forward in building the foundation for a quantum-ready future that will revolutionize computing and digital communication across Canada and beyond.” As part of this collaboration, TELUS is providing Photonic with access to a 30-kilometre dedicated fibre network in British Columbia – configured to test increasingly complex quantum networking that leverages quantum encryption for ultra-secure, tamper-evident transfer of information over long distances. This state-of-the-art infrastructure will enable Photonic to advance critical capabilities in quantum computing (solving complex problems beyond the reach of today’s computers), quantum networking, and quantum key distribution (using quantum signals to create secure encryption). The dedicated fibre network is connected to TELUS’ national infrastructure, offering potential for broader, nationwide testing – and marking the first time a Canadian startup has been granted access to a major telecom operator’s network for the purpose of developing quantum communication capabilities. Photonic

Radioactive radon exposure in Canada is rising and continues to be a critical public health concern, according to the 2024 Cross-Canada Survey of Radon Exposure in the Residential Buildings of Urban and Rural Communities. There are an estimated 10.3 million Canadians living in houses with high radon, increasing their risk of developing lung cancer in the future. The report reveals nearly 18 percent of Canadian homes contain radon levels at or above 200 Bq/m³, the threshold at which Health Canada advises action to reduce indoor radon levels. This is more than double the seven percent of households that were estimated to have radon levels at or above this limit in 2012. The coalition of researchers behind the report, led by Dr. Aaron Goodarzi, PhD, at the University of Calgary, includes scientists at Health Canada and CAREX Canada. “Alarmingly, this report concludes that Canadians are among the most highly radon-exposed people on Earth, and that means we urgently need to address this to avoid a future of prevalent but otherwise avoidable lung cancers,” Goodarzi said in a statement. The report defines radon exposure by specific regions, urban to rural communities and building design types. Radon is a colourless, odourless, and radioactive gas that is the second-largest contributor to lung cancer worldwide. Levels of radon in houses can vary depending on local geology, when a building was constructed, and other factors such as ventilation. In the report, no areas of Canada were found to be free of high radon exposure risk, and all Canadians are urged to test where they live. Informed by data from the 2021 Canadian census and more than 75,000 long-term radon readings from across Canada, key findings include:

- One in five Canadian residential buildings are at or above 200 Bq/m³.

- One in three Atlantic properties are at or above 200 Bq/m³.

- One in six Central Canadian properties are at or above 200 Bq/m³.

- One in five Prairie and NT properties are at or above 200 Bq/m³.

- One in three Pacific Interior and Yukon properties are at or above 200 Bq/m³.

- One in 75 Pacific Coastal Canadian properties are at or above 200 Bq/m³.

The report was funded by the Canadian Institutes of Health Research Healthy Cities Research Initiative, Health Canada, the Alberta Real Estate Foundation, and the Canadian Cancer Society. Cross-Canada Survey of Radon

Bloc Québécois leader Yves-François Blanchet is supporting a First Nation fighting a nuclear waste disposal site near the Ottawa River. Blanchet reaffirmed the BQ’s support for Kebaowek First Nation’s sustained opposition to the radioactive waste disposal site, located about 190 kilometres northwest of Ottawa at Chalk River Laboratories. “The Bloc Québécois stands alongside the First Nations, Quebecers and the 140 municipalities who oppose the Chalk River nuclear dump project,” Blanchet said in a statement. He called on the federal government to immediately suspend the project. The disposal facility would be about one kilometre from the Ottawa River, which is a tributary of the St. Lawrence. The Ottawa River (known as the Kichi Sibi in Algonquin) holds immense spiritual and cultural importance for the Algonquin people, as well as being a source of drinking water for millions. The Canadian Nuclear Safety Commission (CNSC) approved a construction permit for the project last year. Canadian Nuclear Laboratories (CNL) wants to permanently dispose of one million cubic metres of radioactive waste in a shallow mound, as a solution to waste accumulated over the last seven decades of operations and in the future. The company said the containment mound will only hold low-level waste. The Kebaowek First Nation is waiting for the results of a judicial review it filed earlier this year to try and overturn the CNSC’s decision to approve construction of the disposal facility because CNL did not secure the First Nation’s free, prior and informed consent during the licensing process, as mandated under Canadian law. Canada’s National Observer

Montreal-based MEDTEQ+ and Toronto-based AGE-WELL announced the first 16 collaborative projects supported by envisAGE, an initiative created to propel Canada to the forefront of the age-tech sector and foster quality aging nationwide. envisAGE received $47 million from the Government of Canada’s Strategic Innovation Fund in 2022 with the goal of helping small or medium-sized businesses scale up and commercialize 100 age-tech projects. The total ecosystem investment in these 16 projects amounts to almost $20 million, including contributions from collaborative partners and $5 million through the envisAGE initiative. Each project brings a small or medium-sized enterprise with a later-stage technological solution together with an envisAGE Beachhead™ or an Innovation Hub – with experts that will assess the integration of the solution – and a Community Lab, such as an organization working with seniors and caregivers in a real-world setting where the solution will be implemented. In all, the projects involve 16 SMEs and 11 organizations across Canada and will receive a combination of funding, expert coaching and supportive resources through envisAGE to grow and scale innovation. AGE-WELL

The Toronto-based Centre for Aging + Brain Health Innovation (CABHI), powered by Baycrest, launched Ignite, its new funding program to support Canadian innovators designing solutions for older persons. As Canada’s aging population rapidly grows – with nearly 20 percent of people above the age of 65 – so too will the need for innovations that enhance the lives of older persons, including those impacted by dementia. Canadian early-stage innovators – including researchers, point-of-care staff and companies – are developing innovative solutions that can improve the independence and quality of life of older persons and those impacted by dementia. However, these innovators face several barriers that prevent them from translating their promising ideas into real-world impact. Ignite offers funding between $50,000 to $150,000, along with acceleration services, to early-stage innovators, empowering them to develop, test and validate their solutions in real-world settings, with the ultimate goal of getting the best solutions to people who need them most. Funds can be applied to a variety of activities, such as:

- Technological research and development activities.

- Concept and prototype development.

- Testing and simulating activities.

- Validation trials.

Ignite is seeking applications from early-stage Canadian researchers, clinicians, health care organizations and companies with a solution that meets the eligibility requirements and addresses at least one of CABHI’s innovation themes: Aging at Home; Caregiver Support; Care Coordination and Navigation; Cognitive and Mental Health; and Financial Health and Wellness. Ignite will accept submissions until December 2, 2024. CABHI

It is important for businesses to find the right timing to implement artificial intelligence, says an associate professor at York University. It’s not enough for companies to create technology that works effectively and serves a purpose, said Ela Veresiu, an associate professor of marketing at York University’s Schulich School of Business and co-author of a recent study on the topic. Stakeholders, including investors and consumers, need to be ready to accept AI into their lives for the technology to succeed, she said in a Financial Post article by Anthony Marcusa. “We found both academic and practitioner readings didn’t really focus on figuring out the ideal launch date. We saw a gap and opportunity to figure out how to ensure products get widespread acceptance,” Veresiu said. General purpose AI includes platforms such as OpenAI’s ChatGPT and Google Gemini, which offer general information and usage. The second category is domain-specific AI, which includes products that are highly personalized, such as Google Fitbit. Launching domain-specific AI products requires more patience from companies than general-purpose AI, which is seen as less risky, according to Veresiu’s study. “Companies have to create very clear and strong boundaries to limit the AI scope; they have to give consumers longer time to understand the technology,” she said. Even so, she said that we still haven’t reached the optimal launch point for general-purpose AI. She said the flaws apparent in current general-purpose AI, such as hallucinations, exist for a reason, suggesting tech companies are attempting to ease consumers in by presenting AI as innocuous and fallible. Since the technology is far from perfect, consumers feel less threatened, Veresiu said. “Our hunch is it is done on purpose to decrease anxiety and fear of the perfect robot that’s going to take over the world, our jobs, our lives.” Financial Post

The U.S. Department of Commerce’s Bureau of Industry and Security, in conjunction with the U.S. Department of State, announced the removal of Waterloo, Ont.-based Sandvine Incorporated from the Entity List, in light of changes the company has made to its corporate governance and business practices. Sandvine was added to the Entity List in February 2024 after its products – sold to the Egyptian government – were used to conduct mass web-monitoring and censorship and target human rights activists and dissidents, including by enabling the misuse of commercial spyware. The company has since taken significant steps to address the misuse of its technology that can undermine human rights. Over the past several months, Sandvine has overhauled its corporate structure, leadership, and business model. The company has pivoted to focus on servicing democracies committed to the protection of human rights. Sandvine’s actions include, amongst others: exiting non-democratic countries, with 32 already exited and an additional 24 countries in process; fostering deeper relationships with civil society; dedicating profits to the protection of rights; adding human rights experts to its new leadership team; vetting business decisions through the newly created business ethics committee; and closely monitoring technology misuse in countries in which they plan to remain. The Departments of Commerce and State will closely monitor Sandvine's implementation of its commitments. U.S. Bureau of Industry & Security

Germany approved plans for the construction of a €19 billion hydrogen network, deepening its commitment to an energy source that has faced setbacks in recent months. The German Federal Network Agency said it approved proposals from transmission system operators for a 9,040-kilometre hydrogen grid, which will be built out in the coming years and be fully operational by 2032. It’s set to form a core network that will connect industrial hubs – such as steel producers –seeking to decarbonize. Europe’s largest economy wants to replace most of its fossil fuel needs with hydrogen to achieve climate neutrality by 2045. Lately, however, its push has faced setbacks with the cancellation of a key pipeline from Norway. Officials have said that the majority of Germany’s hydrogen needs will need to be covered by imports initially. The original proposal for the core pipeline network was 600 kilometres longer than the plans that were ultimately approved, allowing the estimated cost to drop from €19.7 billion to €18.9 billion. Sixty percent of the network will be converted from existing natural gas pipelines, and the rest will be newly built. BNN Bloomberg

VC, PRIVATE INVESTMENT & ACQUISITIONS

Mountain View, Calif.-based Waymo raised US$5.6 billion to expand its U.S. robotaxi service in an investment round led by Alphabet (which owns Waymo), with continued participation from Andreessen Horowitz, Fidelity, Perry Creek, Silver Lake, Tiger Global, and T. Rowe Price. Waymo said the investment will be used to expand the company’s Waymo One ride-hailing service in San Francisco, Phoenix and Los Angeles, and in Austin and Atlanta in 2025 through an expanded partnership with Uber. Waymo also will continue advancing the Waymo Driver – an AI-powered autonomous driving system – to support a variety of business applications over time. Waymo

Boston-based Seaport Therapeutics raised US$225 million in a Series B financing round. The syndicate was led by General Atlantic, with participation from T. Rowe Price Associates, Inc., Foresite Capital, Invus, Goldman Sachs Alternatives, CPP Investments, and other new investors. Founding investors ARCH Venture Partners, Sofinnova Investments, Third Rock Ventures, and co-founder PureTech Health also participated. Seaport, a clinical-stage biopharmaceutical company, is advancing novel neuropsychiatric medicines. The company said it will use the proceeds to advance its clinical-stage pipeline of first and best-in-class medicines through important clinical milestones, as well as further advance the capabilities of its Glyph™ technology platform, which has demonstrated clinical proof-of-concept. General Atlantic

Vancouver- and Boston-based based Alpha-9 Oncology raised US$175 million in Series C financing, led by Lightspeed Venture Partners and Ascenta Capital. New investors – General Catalyst, a16z Bio + Health, RA Capital Management, Janus Henderson Investors, Delos Capital, Digitalis Ventures, Lumira Ventures and a health care fund managed by abrdn Inc. – joined the round. The round also included existing investors Frazier Life Sciences, Longitude Capital, Nextech Invest, BVF Partners LP, and Samsara BioCapital. Shelley Chu, head of Lightspeed Venture Partners' health care team and Evan Rachlin, co-founder and managing partner of Ascenta Capital, will join Alpha-9’s board of directors. Alpha-9 is a clinical stage company developing radiopharmaceuticals to meaningfully improve the treatment of people living with cancer. The new funding will support human studies for the clinical-stage assets and advancement of discovery-stage assets to clinic-ready development candidates, as well as expanded R&D capabilities, the company said. Alpha-9 Oncology

Montréal-based venture capital firm Brightspark Ventures closed its latest fund, BCOF II, with over $100 million in commitments. The fund, initially targeted at $120 million, will continue Brightspark’s strategy of leading seed rounds and Series A rounds for tech startups across Canada. The firm has also expanded to British Columbia, hiring Vancouver-based Andrew Lugsdin as a new partner to capture more deal flow in the province. The fund has already made two investments – the first is in Deep Sky, a climate tech company developing large-scale carbon removal facilities to help combat climate change. The second investment is in Forcen, an advanced manufacturing startup revolutionizing robotic automation with cutting-edge force-sensing technology. Opalesque

St. John’s, Nfld.-based Kraken Robotics raised $51.75 million through a “bought deal” offering of common shares of the company. A total of 32,343,750 common shares were sold, at a price of $1.60 per common share, for gross proceeds of $51.75 million. The offering was led by Toronto-based investment bank Cormark Securities Inc. as lead underwriter, on behalf of a syndicate of underwriters, including Canaccord Genuity Corp., Beacon Securities Limited, Raymond James Ltd., and Scotia Capital Inc. Kraken is a marine technology company providing complex subsea sensors, batteries and robotic systems. Kraken said the net proceeds of the offering are expected to be used to advance the company’s long-term strategy, including: (1) investing in expanded facilities and increased manufacturing capacity; (2) providing flexibility to take advantage of opportunities for accretive acquisitions of complementary technologies and businesses; (3) increasing the company’s attractiveness as a stable and reliable long-term supplier; (4) strengthening the company’s balance sheet to provide additional working capital to meet customer requirements in connection with potential additional large orders, as well as new program and contract opportunities; and (5) for general corporate purposes. Kraken Robotics

Cambridge, U.K- and Montreal-based Epitopea raised US$31 million in pre-Series A financing. New investors Investissement Québec, adMare BioInnovations and Jonathan Milner joined existing investors Advent Life Sciences, CTI Life Sciences, Cambridge Innovation Capital, Fonds de Solidarité FTQ, the Harrington Discovery Institute, IRICoR and Novateur Ventures, all of whom also participated in this financing round. Epitopea is a transatlantic cancer immunotherapeutics company developing accessible off-the-shelf RNA-based immunotherapies. The company said the additional financing will support strategic pre-clinical discovery in solid tumors of interest while accelerating Epitopea’s near-term clinical development plans for next-generation, tumor- selective, off-the-shelf, RNA-based immunotherapies. adMare Bioinnovations

Vancouver-based venture capital firm Top Down Ventures announced the first close of its US$25-million Founders Fund, designed to fuel early-stage SaaS (software-as-a-service) companies within the managed service provider (MSP) sector. Building on its innovative venture studio model, Top Down empowers MSP software startups with not only capital but also operational expertise and a proven scaling playbook. Top Down’s Founders Fund targets high-potential SaaS companies generating $1 million+ in annual recurring revenue, with seed or Series A investments up to $3 million. Top Down

Vancouver-based Moment Energy was selected by the U.S. Department of Energy for a US$20.3 million award to establish the first UL1974 Certified manufacturing facility in the United States dedicated to repurposing EV batteries. The selection is part of a US$428-million initiative by the Biden-Harris Administration to accelerate domestic clean energy manufacturing in former coal communities across the U.S. The program aims to address critical energy supply chain vulnerabilities while creating jobs and revitalizing communities. Moment Energy will use the funding to construct a state-of-the-art gigafactory in Taylor, Texas to produce safe, reliable and affordable battery energy storage systems from repurposed EV batteries. Work will start the first quarter of 2025 to prepare for the design and development of the facility. Moment Energy

Halifax, N.S.-based Planetary Technologies, which develops ocean-based climate solutions, raised $11.35 million in a Series A funding round led by Evok Innovations. The round included new investors BDC Capital, Amplify Capital, DNX Ventures, and Iconiq Capital. Planetary Technologies uses ocean alkalinity enhancement to remove carbon dioxide from the atmosphere. Roughly 25 percent of CO₂ emissions dissolve into the ocean, increasing acidity. Planetary's process restores coastal environments, helping the ocean remove carbon more efficiently. This method mimics natural processes that have regulated atmospheric CO₂ for millions of years. Planetary said the new funding will allow the company to expand pilot projects, scale operations and further demonstrate the safety and effectiveness of its technology. The company will continue collaborating with local communities, academic institutions and regulatory bodies to ensure its solutions are both scientifically sound and sustainable. Planetary Technologies

Toronto-based Phaseshift Technologies raised $4.1 million in a seed financing round. The round was led by Innospark Ventures, with participation from Draper Associates and follow-on investment from First Star Ventures, which had previously contributed to Phaseshift's pre-seed round. Additional support came from angel investors through Hustle Fund Angel Squad. Phaseshift is an advanced materials company specializing in the development and commercialization of next-generation alloys and composites through its proprietary AI-powered computational platform, Rapid Alloy Design™. Phaseshift said the funding will enable the company to accelerate the development and commercialization of new materials and address critical industrial challenges across a wide range of sectors, including aerospace, automotive, mining, energy, and advanced manufacturing. Business Wire

Vancouver-based MyFO raised $3.5 million in a seed funding round led by Rhino Ventures. The MyFO platform simplifies and organizes financial lives by creating a comprehensive family office platform that consolidates data, documents and stakeholder management. The primary goal is to deliver a secure and intuitive solution tailored to the unique needs of family offices, particularly those with heightened concerns about privacy and data security. MyFO said the funds will be used to scale its operations to meet growing demand, enhance its product offerings, and expand its team. MyFO

Toronto-based AI networking startup Boardy.ai raised US$3 million in an all-equity pre-seed funding round that included Canadian funds Golden Ventures and Garage Capital, and U.S. firm 8VC. Boardy.ai is a professional matchmaking service with a robocall interface. Users call up the AI to discuss what kinds of work connections they’re seeking, and the system then introduces them to other people in the network who might be good fits. Boardy said the funding will be used to enhance the company’s algorithms to provide more personalized and impactful connections, ultimately fostering genuine relationships among users. LeadsOnTrees

Victoria, B.C.-based Open Ocean Robotics (OOR), a maritime robotics and AI company transforming ocean monitoring, raised $2.8 million in an investment round. The round was co-led by Antares Ventures, a Singapore-based deep-tech venture fund focused on sustainability challenges in Southeast Asia, and Spring Impact Capital, a Canadian impact venture fund, with participation from Katapult Ocean, Alacrity Canada, DTN Ventures, individual investors, and Pacific Economic Development Canada. OOR said the funds will support product and technological advancements, geographic expansion into Southeast Asia, and scaling manufacturing of its uncrewed surface vehicles. Traditionally, monitoring coastlines and open waters required fixed assets on shore, satellites, crewed ships or aircraft, which were expensive, labor-intensive and polluting. OOR provides safe, affordable, sustainable and scalable ocean monitoring solutions that are solar-powered, allowing their uncrewed surface vehicles to operate at sea for months at a time, collecting data with a suite of sensors without producing GHG emissions, noise pollution or risking oil spills. Open Ocean Robotics

Toronto-based Mave, the AI assistant for real estate, raised $2 million in pre-seed funding and launched its beta program for agents and brokers. The investment was led by Relay Ventures and N49P, with participation from Alate Partners, Clarim Ventures, and Gambit Partners, along with several angel and strategic investors, including a past president of the Toronto Real Estate Board. Mave automates tasks and handles the back-end marketing and operations of real estate transactions, freeing agents to provide excellent customer service, acquire new clients, and grow their business. Business Wire

Toronto-based fintech startup Parachute raised $1.5 million in a seed funding round to fuel its expansion plans. The round included the Adrenaline Fund, existing investors Highline Beta and ex-Manulife CEO Rick Lunny, and other undisclosed angel investors. Parachute wants to help Canadians saddled with predatory, high-interest debt. The company provides: a debt-consolidation loan with no hidden fees and one lower-cost monthly payment to reset consumer’s finances; a financial wellness app that monitors behaviour and provides education; and a rebate system to motivate customers to make better financial decisions with cash-back rewards. BetaKit

Toronto-based media giant Thomson Reuters Corporation acquired Materia, a California-based startup that specializes in the development of an agentic AI assistant for the tax, audit and accounting profession. Financial details weren’t disclosed. Thomson Reuters, which said the transaction is complementary to the company’s AI roadmap, accelerates the company's vision for the provision of generative AI tools to the professions it serves. Materia’s agentic AI assistant automates and augments research and workflows, helping accountants to improve efficiency, effectiveness and the value they add to their clients. Thomson Reuters

Vancouver-based Spark Real Estate Software acquired Vancouver-based Juniper, a modern homeowner care and warranty service platform for residential developers. Financial details weren’t disclosed. Spark offers customer relationship management software with digital sales, marketing and inventory management solutions for home developers and project marketing firms working on pre-construction residential projects. Juniper focuses on the post-construction phase, offering a homeowner care and warranty service platform that manages service requests for property developers and home builders. Spark said the acquisition of Juniper extends the company’s offering beyond the sales and marketing timeline and into completion, warranty management and homeowner care, covering more of the real estate development journey. Spark Real Estate Software

Generative AI “sucking the air out of the room” in venture capital funding for cloud computing startups: report by Accel

Venture funding for cloud computing startups in the U.S., Europe and Israel this year is projected to rise 27 percent year-over-year, increasing for the first time in three years, according to a Euroscape report from California-based VC firm Accel.

Cloud startups raised $62.5 billion in Europe, Israel and the U.S. in 2023, the report found. Funding is up 65 percent from the $47.9 billion cloud firms raised four years ago, Accel said.

Out of the total raised by cloud firms, 40 percent of all the venture capital funding that flows into cloud companies went to Generative AI startups, Accel said.

“AI is sucking the air out of the room” when it comes to cloud, Philippe Botteri, partner at Accel, told CNBC. “This is both visible on the public market and the private market.”

As of September 30, the Euroscape index – a selection of publicly-listed U.S., European and Israeli cloud firms curated by Accel – is up 19 percent year-over-year.

This pales in comparison with the 38-percent increase the Nasdaq saw this year and is also down 39 percent from the Euroscape index’s peak hit back in 2021.

The cloud industry has been having a tough time beyond AI, with enterprise software budgets squeezed by macroeconomic and geopolitical risks.

“There’s a lot of uncertainty out there,” Botteri said, adding that businesses are increasingly asking questions around geopolitical tensions and macroeconomic factors, which have affected software spending priorities.

The top six Generative AI companies in the U.S., Europe and Israel, respectively, accounted for roughly two thirds of the funding raised by all GenAI startups, according to Accel’s Euroscape report.

Out of the $56 billion total invested intoGenAI firms globally over 2023-24, roughly 80 percent of the cash went to U.S.-based firms, Accel said. Amazon, Microsoft, Google and Meta are each investing an average $30 billion to $60 billion in AI per year.

OpenAI raised a dominant $18.9 billion in 2023-24, taking the lion’s share of VC funding that went to U.S. GenAI companies.

Anthropic raised the second-largest sum among U.S. GenAI startups, with $7.8 billion, while Elon Musk’s xAI came in third.

In Europe, the biggest funding amounts went to Britain’s Wayve, France’s Mistral and Germany’s Aleph Alpha.

Globally, companies building so-called foundational models, which power much of today’s Generative AI tools, account for two thirds of overall funding for Generative AI firms, Accel said.

Dev Ittycheria, CEO of database firm MongoDB, told CNBC that it’s likely the concentration of the most powerful AI models will consolidate to only a select few players that are able to attract the necessary capital to make investments in data centers and chips to train and run their systems. CNBC

REPORTS & POLICIES

Canadian businesses grappling with rising costs, looming shortage of workers, technology disruption: BDC report

An overwhelming majority of Canadian businesses are struggling with rising costs and say it will be as hard or harder to find employees in the next five years, according to a study by BDC.

On top of that, more than one-third of businesses are anticipating significant disruption from new technologies, says the study, which looked at four key trends shaping the future of Canada’s businesses.

Over the past five years, small and medium-sized enterprises have had to adapt to a number of crises: the COVID-19 pandemic; the 2021-2023 global supply chain crisis; rising inflation, labour shortages and rapid technological change – including a rapid rise in e-commerce and conversational artificial intelligence.

The BDC (Business Development Bank of Canada), Canada’s bank for entrepreneurs, said the study offers insights and tools to help entrepreneurs anticipate what’s ahead and make informed decisions to ensure long-term success.

Seventy-five percent of businesses say rising costs have affected their business, according to the study.

The industrial product price index, which tracks the price of products at factory gates, increased by 35 percent between spring 2020 and spring 2022.

While some input prices have and will come down, the study says that the price of energy will remain high as extreme weather events affect electricity output, new investments to increase the electricity supply are slow to happen, and geopolitical situations maintain natural gas prices above the pre-pandemic average.

“Optimizing energy consumption and adopting cost-saving technologies can mitigate these pressures,” the study says.

While automation and AI tools can help cut costs and boost efficiency, it is important to focus on improving business processes before investing in new technology, to identify inefficiencies and maximize the impact of these investments, the BDC advises.

Eighty-eight percent of businesses think it will be just as hard or harder to find employees in the next five years, according to the study. Labour shortages will remain a pressing issue, particularly with respect to skilled workers.

Nearly 70 percent of future job openings will require post-secondary education or management skills, which are areas currently reporting the lowest unemployment rates, making it even harder to find qualified candidates.

Among businesses anticipating worsening labour challenges, 33 percent are not planning strategies for hiring, training or retaining employees. There is a significant gap in preparedness, primarily among small businesses of less than 100 employees.

The study presents the top three strategies for dealing with labour shortages:

- Technology and automation can reduce the time employees spend on repetitive or low-value tasks. This makes it possible to produce more with less employees.

- A people strategy with competitive compensation, growth opportunities and a positive culture can help attract and retain talent.

- Expanding the hiring pool by upskilling candidates through training, forming partnerships with universities and schools, and hiring diverse workers can help ease labour and skills shortages.

Eighty-two percent of businesses already consider technology critical, and 38 percent anticipate significant disruption from new technologies, so it is imperative for entrepreneurs to embrace digital transformation, the study says.

Advanced technologies, such as AI, cloud computing, and cyber security, can also help by enhancing productivity, improving customer service, and providing a competitive edge.

“We are past the point where adopting new technologies is good advice; it is mandatory,” Pierre Cléroux, vice-president, research, and chief economist at the BDC, said in a statement.

“Increasing costs, changing consumer behaviours, labour shortages and technological trends all interact with one another. By adopting new technologies, small businesses can turn potential disruptions into opportunities to shape their own future and drive their business forward,” he said.

The study also found that about two-thirds (66 percent) of Canadians are willing to pay extra for locally produced products, and 50 percent are willing to pay extra for environmentally friendly products or services.

“Zoomers,” who were born between 1997 and 2012, are significantly more likely to pay more for environmentally friendly clothes, shoes and accessories (71 percent) compared with other generational cohorts (54 percent).

Considering that all Zoomers will be adults by 2030, the market for environmentally friendly products and services will continue to expand, the study notes.

Offering competitive pricing without compromising quality and promoting more local and environmentally friendly products are great ways to attract and retain these new consumers, the BDC said.

Adopting environmental, social, and governance (ESG) criteria can attract major buyers as well. In a previous study, the BDC forecasted that 92 percent of major buyers would require their suppliers to disclose at least one ESG criterion this year.

Reporting on ESG efforts is increasingly necessary to enter the supply chain of large companies. In 2022, 59 percent of suppliers had to disclose some ESG criteria to at least one buyer. This is expected to rise to 72 percent by 2025.

The BDC’s study is based on an online survey of 1,278 business owners and decision-makers, as well as a survey of 1,503 members of the Canadian general population. BDC

*****************************************************************************************************************************

Canadian organizations investing more in technology, seeing profits from AI implementation

Canadian organizations reported they’re investing more in technology solutions than their global peers and seeing impressive returns on their investments, according to the 2024 KPMG Global Tech Survey.

The survey, which included 150 C-suite technology executives and senior leaders from large organizations across Canada, showed Canadian respondents are currently investing in or planning near-term investments in technologies such as AI and automation, edge computing, quantum computing, cybersecurity, Web 3, data and analytics, cloud computing and other solutions in the next year to support their growth ambitions – outspending their global peers.

“After years of relative underinvestment, Canadian organizations have done a major pivot and are now investing more in technology than their global peers – this is a significant leap forward. With more sustained investments like this, Canada’s productivity could finally see a meaningful boost,” Stephanie Terrill, KPMG’s Canadian managing partner of digital and transformation, said in a statement.

Nearly nine in 10 (89 percent) of respondents said their technology investments were driven by successful pilot projects and proof-of-concept testing of various solutions.

Among the most profitable technologies over the past two years were: artificial intelligence, where more than half (56 percent) of respondents saw a 10-percent or more profit increase from their investments; cybersecurity (56 percent) and data and analytics (53 percent).

Over the past year, more Canadian organizations have accelerated technology implementations in data and analytics, cybersecurity and cloud computing.

But the largest increase was in AI and automation (including Generative AI), where nearly all (99 per cent) of respondents said they had started implementing AI – a 39-percent increase from last year.

Nearly eight in 10 (79 per cent) said they have AI use cases that are either running, in production or being scaled across their organization, and they’re achieving a return on investment.

Nearly all (93 percent) of Canadian respondents said transformation efforts involving AI and Generative AI positively impacted their organization’s profitability. This is in stark contrast to last year’s survey, where almost one-third (29 percent) of Canadian organizations said they hadn’t taken any action on AI.

However, among respondents that have started implementing AI, only 38 percent are proactively progressing against their strategy, while more than half (56 percent) are either behind schedule or being held up by investment approvals.

This year’s survey also found that lack of defined AI regulations and requirements in Canada is hampering investment and implementation due to uncertainty and fear of risks. It’s also hampering the speed of evolution and maturity of AI governance.

Despite increased investments in technologies like AI and the benefits they’re creating for Canadian organizations, nearly eight in 10 (78 per cent) of respondents expressed fear of overspending on technology – 11 percentage points higher than the global average.

That fear could stem from risk aversion: more than six in 10 (63 percent) of Canadian respondents said risk aversion makes their senior leadership move more slowly than competitors in embracing new technology – seven percentage points higher than the global average.

This year, more than 90 percent of Canadian organizations reported at least a five-percent increase in profitability across all technology categories, although 66 percent indicated that keeping up with the pace of change was difficult. In 2023, 35 percent of Canadian organizations indicated no increase in profitability across all technology categories.

Canadian organizations are still worried about being able to fully realize their technology goals with their current talent, and upskilling will likely be a large area of investment.

In addition, 89 percent said that AI would cause significant restructuring of job roles and require major investments for upskilling.

Everything-as-a-service (Xaas) was a top investment priority for 89 percent of Canadian organizations, while cybersecurity came in second at 70 percent.

Canadian respondents valued the improved efficiency gains from implementing XaaS and its ability to accelerate other technology adoption, and 94 percent noted an increase in profitability from their use of XaaS technologies including multi-cloud and public cloud.

Canadian organizations appear to have a slight edge over their global peers when it comes to leveraging data for monetization or competitive advantage, but are behind when it comes to data security and data accessibility (ensuring employees have the data they need to fulfill their roles).

The top three challenges Canadian tech leaders see as most likely to slow down transformation efforts are:

- A risk-averse culture that is slow to embrace change.

- Skills shortages within their organization.

- Immature data management strategies. KPMG

*****************************************************************************************************************************

Fewer businesses hit by cyber-attacks, but recovery costs of such incidents are increasing

Total spending by Canadian businesses to recover from cyber security incidents doubled in 2023 compared with 2021, according to a report by Statistics Canada.

Total spending on recovery from cyber security incidents doubled from approximately $600 million in 2021 to $1.2 billion in 2023, based on data from the Canadian Survey of Cyber Security and Cybercrime. This followed an increase of about $200 million from 2019 to 2021.

Large businesses accounted for almost half of total spending on recovery from cyber security incidents in 2023 (about $500 million), while medium-sized and small businesses each spent approximately $300 million.

The trend of increasing recovery spending may indicate that, although a lower percentage of businesses fell victim to cyber security incidents, the financial consequences of being hit by these incidents are becoming more severe.

In contrast to recovery spending, total spending on prevention and detection of cyber security incidents rose at a slower pace, increasing from $9.7 billion in 2021 to $11 billion in 2023.

Large businesses accounted for almost half of the total in 2023 ($4.8 billion), followed by medium-sized ($3.6 billion), and small ($2.6 billion) businesses.

The proportion of businesses that reported spending money to prevent or detect cyber security incidents decreased from 61 percent in 2021 to 56 percent in 2023.

The largest cyber security cost for businesses in 2023 was employee salary related to prevention or detection ($3.8 billion). Half of businesses (50 percent) reported having cyber security employees in 2023, down from 61 percent in 2021.

The most reported reason for not having cyber security employees was that the business used consultants or contractors to monitor cyber security (47 percent). Consultant or contractor expenses were the third-largest prevention or detection cost ($1.9 billion), following cyber security software costs ($2.9 billion).

In addition to hiring expenses, just over one-fifth of businesses (22 percent) provided formal training to develop or upgrade the cyber security skills of their non-information technology employees in 2023. The cost of providing training to employees, suppliers, customers or partners totalled over $300 million.

In 2023, about one in six (16 percent) of Canadian businesses were impacted by cyber security incidents.

The proportion of businesses impacted by cyber security incidents has been declining since 2019, with 21 percent of businesses being impacted that year and 18 percent in 2021.

This trend is consistent with the United Kingdom's Cyber Security Breaches Survey, which found that the proportion of businesses impacted by cyber breaches or attacks also decreased in the U.K. from 2019 (18 percent) to 2022 (12 percent).

In Canada, large businesses reported the largest drop in 2023 (-7 percentage points) but remained the most likely to be impacted (30 percent).

The top five private sectors most impacted by cyber security incidents in 2023 included: Finance and insurance (25.5 percent); Information and cultural industries (24.7 percent); Mining, quarrying and oil and gas extraction (21.3 percent); Professional, scientific and technical services (21.1 percent); and Wholesale trade (20.9 percent).

In contrast to the trend observed for Canadian businesses, the Canadian Internet Use Survey found that the proportion of Canadian individuals aged 15 and older experiencing cyber security incidents has been rising since 2018.

Over two-thirds (70 percent) of Canadians experienced a cyber security incident in 2022, up from 2020 (58 percent) and 2018 (52 percent).

While the proportion of Canadian businesses impacted by cyber security incidents declined overall in 2023, certain methods of attack were significantly more prevalent.

Identity theft had the largest change, with just under one-third (31 percent) of impacted businesses experiencing incidents using that method. This was an 11-percentage point increase from 2021.

The next largest increase was for scams and fraud (50 percent), up by six percentage points from 2021. Scams and fraud remained the most commonly used method for cyber security incidents.

In 2023, over one in eight (13 percent) of impacted businesses reported experiencing ransomware attacks, up from 11 percent in 2021.

The majority of ransomware victims did not make a ransom payment (88 percent). Of those that did indicate making a ransom payment, the majority (84 percent) paid less than $10,000, while four percent paid more than $500,000.

The COVID-19 pandemic forced many Canadian businesses to move more of their operations online, requiring them to also adopt additional cyber security precautions. Many of these precautions continue to be used even as pandemic-related restrictions have been lifted, StatsCan said.

Just over one in four Canadian businesses (26 percent) had written policies for cyber security in place in 2023, the same proportion as in 2021 (26 percent).

Meanwhile, 22 percent of businesses had cyber risk insurance in 2023, up six percentage points from 2021 (16 percent).

For those with cyber risk insurance, their policies covered items such as direct losses from an incident (53 percent), restoration expenses for software, hardware and electronic data (44 percent), business interruptions (39 percent) and financial losses (38 percent).

The proportion of businesses conducting any activities to identify cyber security risks (59 percent in 2023) has also been relatively stable since 2019 (60 percent).

The most common cyber security activity in 2023 was monitoring network and business systems (46 percent), followed by monitoring insider threat risk behaviours (22 percent).

About one in eight (13 percent) of Canadian businesses impacted by cyber security incidents reported incidents to police services in 2023, up three percentage points from 2021 (10 percent).

Large businesses were the most likely to report incidents (16 percent), followed by medium-sized (15 percent) and small (12 percent) businesses.

The leading types of incidents reported were incidents to steal money or demand ransom payment (56 percent of businesses reported incidents to police services), followed by incidents to steal personal or financial information (33 percent).

Among impacted businesses that did not report all incidents to police services, the primary reasons given for not reporting were that the incidents were resolved internally (55 percent), were too minor (35 percent), or were resolved through information technology consultants or contractors (31 percent). Statistics Canada

*****************************************************************************************************************************

Nonprofits consider digital skills “very important,” but nearly half of organizations are just starting to develop these skills

The vast majority of managers and frontline staff at nonprofit organizations think digital skills are very important or necessary for mission operation and daily operations, according to a report led by the Canadian Centre for Nonprofit Digital Resilience.

Yet most nonprofits are only in the early or intermediate states of digital development, says the study, Assessing the Digital Skills Gap in Canadian Nonprofits.

Among respondents to a survey, 11 interviews and one focus group, 81 percent said digital skills were “necessary” or “very important” for accomplishing their organizations’ missions.

However, nearly half of respondents (47 percent) described their organization as having “basic” digital skills or as “just starting out” in their digital skills development journey.

Digital skills were perceived as most important for allowing nonprofits to deliver better services, serve more people, operate efficiently, and develop new services.

There were gaps between respondents' perceptions of what skills were important for their organization and how developed their organizations’ skills were, the report found. The largest gaps were for data skills, but significant gaps were also noted for basic digital skills and remote work.

Respondents accessed a wide range of supports to develop their digital skills; they were most likely to have accessed free resources, including online guidance, webinars and free training.

However, they rated paid resources, including paid training and working with digital experts, as among the most useful resources – indicating a mismatch between the supports they access and those that may be most impactful.

Financial and resource constraints were among the most common barriers experienced by respondents when accessing digital skills development resources.

Respondents also cited information gaps, including around navigating existing training resources and understanding where to start their digital skills initiatives. Interviewees indicated that adjustable or tailored services may be particularly valuable.

Digital skills gaps hold back much of the nonprofit sector, said study co-authors Emma Elborne-Weinstock, a senior associate at Toronto-based Blueprint (a partner on the report) and Max Palamar, vice-president of data capacity and analytics at Blueprint.

“Our findings on both the importance of digital skills and the frequency with which nonprofits experience gaps indicate a missed opportunity for stakeholders to better serve their clients and achieve their missions.”

Gaps in digital skills may restrict the quality of services they offer, the reach of those services, their efficiency, and their ability to innovate new and better responses.

Also, cost constraints cause mismatches between needs and digital skills responses. The low level of uptake of paid resources among respondents, including for paid training and support from digital experts, contrasted with the high ratings of their usefulness.

“These findings suggest that while some digital upskilling approaches with direct financial costs may be highly valuable for nonprofits, financial constraints may keep them from accessing them," the study's authors said.

The second-most cited barrier involved challenges in understanding where to start on a digital upskilling journey. Survey respondents in management positions indicated that selecting training and identifying the role requirements of new hires represented significant challenges.

The report makes three major recommendations:

- Consider approaches that provide targeted guidance at low cost. Approaches that can support nonprofits in mapping and implementing their digital development strategy without a high cost could empower them to best use their limited resources. Solution designs should consider cost from the outset to improve accessibility and sustainability.

- Focus on high-yield basic and data-focused interventions. Interventions focused on basic, low-intensity digital skills that don’t require a technical background may have the best chance to create an immediate impact. However, any solution should be accompanied with an assessment to understand how relevant each skill area is to a given organization.

- Tailor responses to the needs of organizations while maintaining scalability. While organizations indicated relatively common needs in basic digital skills and data skills, they also indicated a wide range of specific needs that varied by organization. Given the diversity of nonprofits with digital skill needs, an effectively scalable response should allow flexibility to respond to the priorities and strengths of individual organizations. However, this flexibility needs to be balanced with an understanding of which challenges and solutions are most commonly relevant and can be efficiently replicated across organizations.

Partners in the report, which was funded by the federal government’s Skills for Success program, included: Imagine Canada, Digital Governance Council, Toronto Metropolitan University, The Dais, and Blueprint. Canadian Centre for Nonprofit Digital Resilience

******************************************************************************************************************************

Industry urges provincial governments to improve and harmonize carbon markets

Trade associations and companies representing industries that include manufacturing, steel, cement, oil and gas, chemistry, carbon removal and renewables are calling on provincial governments to improve and harmonize carbon markets.

In an open letter to provincial ministers of the environment, the associations and companies said they support industrial carbon pricing “as the backbone of decarbonization across this country.”

Industrial carbon markets are the most flexible and cost-effective way to incentivize industry to systematically reduce emissions, they said.

However, a patchwork of provincial carbon pricing systems has produced numerous barriers and created significant red tape across efforts to decarbonize our economy, the signatories to the letter said.

“The disconnect across nine different markets makes it harder to invest in major projects in Canada. It is holding back capital, economic growth, jobs, and decarbonization. We need to act now to fix this,” they said.

They propose five “essential fixes” to ensure that industrial carbon markets perform at their full potential:

1. Remove interprovincial trade barriers: Remove the interprovincial trade barriers that prevent a carbon credit (e.g. offset, emissions performance credit, etc.) generated in one province from being recognized in another. Free industry to buy and sell these credits across provincial borders.

2. Create and align high-integrity offset protocols: High-integrity offsets represent emissions reductions or removals that are permanent, additional and verifiable. They provide more pathways for industry to pursue decarbonization. The current patchwork of protocols across provinces can be aligned over time, but we need to start now to boost decarbonization and seed important new industries such as carbon dioxide removal.

3. Make credit markets transparent: Investors are confronted with several different carbon credit markets and large emitter programs across Canada, and most do not provide public information about transactions or credit prices. Minor regulatory changes that increase transparency can make markets easier to navigate and understand, encourage greater participation, inspire investor confidence, and facilitate investment. Market transparency also opens the door to providing greater certainty to firms through the use of carbon contracts for difference, which essentially guarantee a future price for carbon.

4. Enhance revenue recycling: To support decarbonization efforts, provinces should create predictable, efficient and transparent programs to reinvest 100 percent of industrial carbon pricing revenues back into industry to accelerate additional decarbonization. Enhanced revenue recycling would better position Canadian industry as a global source of low-carbon products and help us to compete globally.

5. Engage on measures at the border to support vulnerable sectors: Border measures can prevent carbon leakage to jurisdictions with less advanced climate policies. The European Union is already implementing a Carbon Border Adjustment Mechanism, and more jurisdictions may soon follow with similar measures. In Canada, border measures are under federal jurisdiction, but provinces are stewards of their industrial carbon pricing systems. Provinces can and should push the federal government to accelerate the conversation about climate policy and the global competitiveness of Canadian industry.

Their open letter concludes: “To be successful, we need provincial leaders working together towards a common vision for decarbonization in this country. Our economy and environment depend on it.”

Signatories to the letter include: Alberta’s Industrial Heartland, Canadian Manufacturers & Exporters, Canadian Steel Producers Association, Carbon Removal Canada, Canadian Renewable Energy Association, Cement Association of Canada, Chemistry Industry Association of Canada, Clean Prosperity, Enhance Energy, Heidelberg Materials, Itoa Energy, Kiwetinohk Energy, and Lafarge. Clean Prosperity

*****************************************************************************************************************************

International students miss fall semester at Ontario colleges; Ontario government to prohibit foreign students from studying at province’s medical schools

Thousands of international students expected to study at three Ontario colleges are missing the fall semester after Ottawa announced it would further tighten Canada's study permit system, CBC reported.