The paradox of corporate profitability in Canada

“Paradox” is defined as a seemingly absurd or self-contradictory statement or proposition, which, when investigated or explained, may prove to be well founded or true. As a relevant example, try the following thought experiment: consider a mid sized country with poor and declining R&D spending and low ranking for innovation. How profitable would its companies be? Probably not very profitable, you might think.

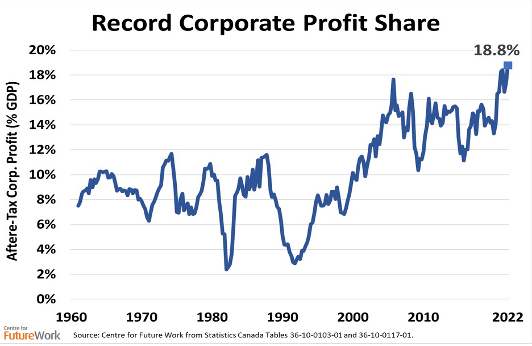

Now consider Canada, a mid sized country with poor and declining R&D spending, as well as a low ranking for innovation. Yet its corporate profits are sky high. As indicated by this chart after-tax corporate profits in Canada as a percentage of GDP, this is not a flash in the pan or just one outstanding year. Profits as a percentage of GDP have been rising steadily for thirty years. They are close to twice the profitability of US companies as a percentage of GDP.

What is going on?

There are probably a number of factors involved, among them: corporate concentration, corporate size, and free trade.

Corporate concentration

It is well known that Canada has many very concentrated markets. Examples include airlines, telecoms, banks, and retail pharmacies. Canada’s food system is also among the most concentrated in the world. It is also well known that concentrated markets confer market power that allows participants to raise prices higher then they could in more competitive markets. There has been much debate about the reasons for this concentration, much of it focusing on the Competition Act and its enforcement (or lack thereof).

Corporate concentration has been increasing. A 2019 paper by Ray Bawania and Yelena Larkin from York University found that corporate concentration had increased in Canada since the late 1990’s, as it had in the US. They attributed two reasons for this: weak antitrust legislation and practices increasing barriers to entry. They also noted how large firms had become more dominant. Firms in industries with the largest increases in product market concentration started to generate higher profit margins, with the volume of M&A deals — and horizontal deals in particular —increasing.

Corporate size

Companies have been getting bigger, partly driven by significant merger and acquisition activity. It is also very likely that information technology has also helped companies get larger, as it facilitates the management of supply chains, logistics, communications, e-commerce, and much else.

“The larger companies can charge higher prices because consumers don’t have as many options,” said Karim Bardeesy, executive director of Toronto Metropolitan University’s Leadership Lab, in a report published late last year. “And consolidated industries are less responsive to consumer feedback.”

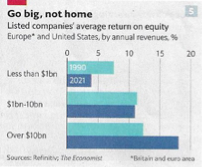

Above all, as this graph shows, larger companies are also more profitable.

Source: The Economist, March 18th 2023

Source: The Economist, March 18th 2023

Free Trade

The Free Trade Agreement of 1988, followed by NAFTA in 1994, represented a major change for Canadian business. It significantly increased cross-border trade and investment. A study from Ryerson University showed that by 2012 profitability of Canadian firms had been increased by NAFTA, which they said was consistent with economic theory. That trend has continued since.

Does this matter?

One of the main objectives of a company CEO is to generate profits for his or her shareholders. Canadian CEOs seem to be doing this very well, so the mindset seems to be “why spend on R&D and innovation if we’re doing so well?”

Canada ranks 14th in the Global Competitivenes Report put out by the World Economic Forum. The OECD projects growth in real per capita GDP for Canada of below 1 percent a year, up to 2060. It is the worst performing of 38 advanced countries for 2020-2030 and also for 2030-2060.

These are not encouraging numbers. Per capita GDP is the basis for our standard of living and provides resources to pay for services such as health care and services for an aging population. It is to be hoped that the new Canada Innovation Corporation will be able to play a role to change this mindset and increase R&D, innovation and eventually economic growth and per capita GDP in Canada.

Read more: New innovation agency’s success hinges on its private sector leadership, experts say

Peter Josty is Executive Director of The Centre for Innovation Studies (THECIS), a Calgary-based not-for-profit research company specializing in innovation and entrepreneurship. In addition to working in private research and business development, he holds a PhD in chemistry from the University of London and an MBA from the International Institute for Management Development in Geneva.

R$

| Organizations: | |

| People: | |

| Topics: |

Events For Leaders in

Science, Tech, Innovation, and Policy

Discuss and learn from those in the know at our virtual and in-person events.

See Upcoming Events

You have 0 free articles remaining.

Don't miss out - start your free trial today.

Start your FREE trial Already a member? Log in

By using this website, you agree to our use of cookies. We use cookies to provide you with a great experience and to help our website run effectively in accordance with our Privacy Policy and Terms of Service.