Government must stop giving financial “handouts” to foreign multinationals and procure more Canadian technologies

The federal government must stop giving financial subsidies and intellectual property to foreign companies and procure many more technologies and services from innovative Canadian firms, says one of Canada’s most prominent venture capitalists.

The federal government must stop giving financial subsidies and intellectual property to foreign companies and procure many more technologies and services from innovative Canadian firms, says one of Canada’s most prominent venture capitalists.

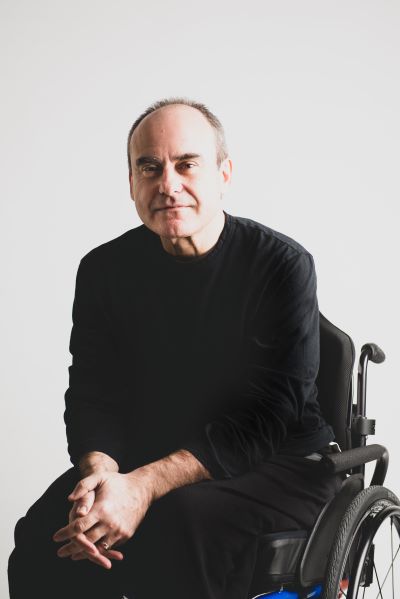

Canada also needs to get its spending under control so it can implement tax reforms and should stimulate more competition and technology adoption among businesses, said John Ruffolo (photo at right), founder and managing partner of Maverix Private Equity and co-founder and vice-chair of the Council of Canadian Innovators, in conversation with Jeffrey Crelinsten, Research Money's publisher and CEO.

“We’ve been doing handouts [to foreign companies] like crazy,” he said during Research Money’s inaugural podcast.

Foreign companies receive hundreds of millions to billions of dollars in taxpayers’ money and they also keep the IP, talent and other intangible assets for the benefit of their countries, not Canada, he said.

“Folks, this is not a path for prosperity. You do not own the ultimate intangibles from the business,” Ruffolo said. The two countries that understand this more than any other nation are China and the United States, he added.

“They’re going through this cold war of IP ownership while Canada sits by and just looks in the rearview mirror and is looking to grab crumbs,” he said.

The federal government’s policies on innovation and taxation are still based on a 70-year-old model – which started with the auto manufacturing assembly line – of using physical industries and job creation to generate economic wealth, Ruffolo said.

But that outdated model no longer works in today’s global digital economy where wealth is created by owning and retaining IP, talent and other intangible assets, he said.

The biggest and wealthiest companies in the U.S., such as Amazon, Microsoft, Google (Meta), Apple and Nvidia, are essentially IP-driven firms that are generating revenue from their IP at nearly 100-percent margins, Ruffolo said.

“Whether you are tech-enabled or a tech company as classically defined, the real point is either way the world is a digital world,” he said.

Finding, supporting and growing Canadian tech companies that retain their IP, talent and other intangible assets in Canada is the way for the country to prosper and compete globally, Ruffolo said. “It is the key to the future.”

Instead, the federal government within the last month allocated $110 million of the nearly $229 million from the Strategic Innovation Fund toward supporting foreign multinationals, investing in their outputs and capacity, the Council of Canadian Innovators pointed out.

Foreign direct investment (FDI) makes sense only when it’s done strategically, Ruffolo said, such as attracting foreign companies to contribute financially to building made-in-Canada value chains where the IP and other intangibles benefit Canada.

The U.S. and China are promoting industries they think are strategically important, such as chips and AI in the U.S., Ruffolo noted. “We do need to make those bets in Canada and actually help accelerate some of those critical industries.”

Government fails on domestic procurement, businesses slow to adopt technology

The federal government also is failing badly at procuring goods and services from Canadian companies, in many cases choosing foreign suppliers instead, Ruffolo said.

For example, Ottawa plans to spend $6 billion in partnership with Australia to develop over-the-horizon radar technology to provide advanced early warning and long-range surveillance in Canada’s Arctic.

Yet the government ignored an Ottawa-based company, D-TA Systems, that has been an international leader in producing such technology, including for the U.S. Department of National Defense and companies that supply the U.S. military.

Similarly, the government provided Sweden-based Ericsson with $79.1 million from the Strategic Innovation Fund last November, plus a $634.8-million contract, to advance 5G technologies for next-generation telecommunications networks in Canada.

The federal government spends about $37 billion annually procuring goods and services. Yet Canadian companies that are deservedly competitive from a global perspective have the worst time selling to the federal government, Ruffolo said.

He said he has invested numerous times in Canadian companies where they could not secure a dollar of procurement in Canada and had to go to the United States and were able to sell there first “before the Canadian government would even take a look at them.”

“It is complete and utter nonsense,” he said. “Many of the Canadian companies, as long as they’re of similar quality and value, why wouldn’t [government] pick the Canadian one? It just baffles me.”

It’s one of the easiest things government could do to help grow and retain innovative companies in Canada, Ruffolo said. “It doesn’t cost the taxpayers anything because they [government] have to procure these services or goods anyway.”

Even committing two to three percent of annual federal procurement spending to Canadian companies would open up markets in this country, he said. “And it’s not a handout. A dollar of revenues is worth a multitude greater than a dollar of handouts.”

Another area of weakness in Canada’s innovation ecosystem and economy is the slow adoption by businesses of artificial intelligence and other new technologies, including made-in-Canada technologies, Ruffolo said.

“As a Canadian citizen and taxpayer, it is frustrating that they don’t move as quickly as they probably should,” he said.

The reasons why are complex, but have to do with the lack of venture capital in Canada compared with the U.S., too little competition in protected industries such as banking, telecommunications, retail groceries and others, and the generally conservative mindset of large corporate Canada, Ruffolo said.

“Where you’re capital-constrained, there might be more of a reluctance to make some of these changes that might suck up a lot of capital as you start replacing your human labour with machine labour,” he said.

Large corporate Canada is focused on distributing dividends rather than investing in small and medium-sized businesses that are aggressively using new technologies to differentiate themselves from the incumbent competition, Ruffolo said.

The reason for the slow technology adoption definitely does not have to do with having enough quality talent in Canada, he noted. “Perhaps it is a function of the leadership in some of those [Canadian] businesses.”

Those industries and sectors that government has protected through policies and regulations are going to suffer greatly if Canada ever opens its border to foreign-based competition in those industries, he predicted.

For example, government has been talking for about seven years about implementing an open banking system. Many countries have adopted open banking and it’s a great convenience for consumers, Ruffolo said.

“It would have helped many of these innovative [Canadian] fintech companies to rapidly grow,” he said. “And frankly it would actually even help our Canadian banks in that it sharpens [them] up.”

Canada’s big banks already have many advantages, including in capital, distribution and brands, he said. “They have nothing really to fear.”

“That open banking regulation is one of the first things to pull back the curtain a little bit on an oligopoly that we created on this presumption that it helps maintain the security of our banks.”

How Ruffolo would change Canada’s innovation ecosystem

Podcast host Jeffrey Crelinsten asked Ruffolo what he would change if he were in charge of the federal government’s innovation policy file.

Ruffolo said the first thing he’d do is address government spending, which he described as “completely out of control.”

“And the problem with the out of control [nature] of our spending is that it creates unnatural acts in all of the things that we do,” he said. “I think the public is now fed up with waste and inefficiency. So I’d start off [by doing] a full review of the cost structures in government.”

Getting spending under control will enable the significant taxation reform that Canada requires he said. “The reason why our taxes are so uncompetitive is that we’re trying to pay for out-of-control spending.”

“So if you get the spending in control, then your competitiveness for tax gives you the room to compete more effectively, particularly against the U.S. as that’s going to be even more relevant for us in the next decade.”

Once spending is controlled and taxation reformed, that will help eliminate the problems getting in the way of Canadian entrepreneurs, innovative companies and investors, Ruffolo said. “It opens you up to focus in on a prosperity agenda, focused around access to capital, access to talent and access to customers and markets.”

On the procurement front, he said, “When you’re looking to procure services and if there is a Canadian company that’s of [the] same or similar quality and value, choose Canada. It’s just a no-brainer.”

When it comes to foreign direct investment, Ruffolo said the government is giving financial subsidies to foreign companies “that use the money to further make sure that Canadian-based companies cannot ever compete against them.”

“We’ve lost our collective mind of common sense” he added. “The U.S. doesn’t do this, because they would think that’s absolute nonsense.”

The criteria for awarding money under the federal Strategic Innovation Fund should be changed to provide funding only to companies where the IP, talent and other intangible assets are retained in Canada to benefit this country, Ruffolo said. “Why would we otherwise use Canadian taxpayer dollars to subsidize businesses where we don’t ultimately benefit for it?”

Canada also needs to do more in creating opportunities to keep talented Canadian graduates here, rather than going to the U.S. and other countries, he said. “There’s only one way to do it: by building great Canadian companies so that they would want to stay here and work for those Canadian companies.”

That will lead, in many cases, to those talented Canadians spinning off startups and building their own businesses here, he said. Canada must do more to support those entrepreneurs and grow those businesses, he added.

“Life being an entrepreneur is not rosy in the least. It is brutal and it’s punishing. And they need all the help they can get,” Ruffolo said.

“It’s high time in Canada [to] stop with the negative narrative and actually embrace these entrepreneurs for the wealth and the jobs and the social services they’re ultimately helping us fund are celebrated, and not chastised.”

Impacts on Canada from the massive shift away from globalization

Ruffolo said the world is going through a massive deglobalization transformation. “When you go through deglobalization, what’s probably going to be the end result is the entire world economically speaking will suffer – everybody will.”

The future “is looking like regionalization of the world,” he added.

The U.S. currently exports only about three percent of its goods and services and is the only country in the world with a sufficiently large domestic consumer market that could absorb the country’s own production, Ruffolo said. So the U.S. will probably suffer the least in the deglobalization shift, he said.

He said he expects Canada will become increasingly economically tied to the Americas, especially to the United States and the success of its economic future. “This will mean making sure, if you want to be a successful Canadian company, [in] having clear and unfettered access to their [U.S.] markets, being part of their supply chains.”

Despite what U.S. President Donald Trump professes, the U.S. loves getting Canada’s energy and mineral supplies and Canadians will have to figure out things they really want from the U.S., Ruffolo said.

There has been a lot of discussion about Canadian companies not using just the U.S. for their market, but expanding into Europe and Asia, he noted.

“I think you’re going to see a retreat back from that concept,” he said. “The Americas will likely dust off the Munroe Doctrine where they basically created a shield around North and South America and will be trading up and down it and leveraging resources.”

Ruffolo predicted there’ll be a reinvestment in more military in the Americas, particularly in naval and air military resources, to guard the borders.

Research Money’s inaugural podcast was recorded when Trump was just beginning to threaten tariffs on Canada and other countries.

Since then, he has implemented 25-percent tariffs on Canadian aluminum, steel automobile parts and vehicles. Last week, Trump announced minimum 10-percent “reciprocal tariffs” on dozens of countries (excluding Canada and Mexico) and even higher rates for trading partners like China and Europe.

Expert observers think if Trump continues with his tariff war, it will change the foundation of the global trading system, the worldwide economy and existing alliances.

Ongoing tariff wars also may change Ruffolo’s perspective that Canada will be increasingly linked economically to the U.S., especially with Liberal Leader Mark Carney saying that the existing Canada-U.S. relationship, including in trade, is over.

Research Money is planning to do a second podcast with Ruffolo to get his current perspective, especially since the global economy and geopolitical order are changing so rapidly.

Click here to listen to Part 1 of the podcast with John Ruffolo, in which he also talks about creating OMERS Ventures, supporting Hootsuite with Canada’s first Silicon Valley-type venture capital deal, his founding and rationale for Maverix Private Equity, and his co-founding (with former BlackBerry co-CEO Jim Balsillie) of the Council for Canadian innovators.

R$

| Organizations: | |

| People: | |

| Topics: |

Events For Leaders in

Science, Tech, Innovation, and Policy

Discuss and learn from those in the know at our virtual and in-person events.

See Upcoming Events

You have 0 free articles remaining.

Don't miss out - start your free trial today.

Start your FREE trial Already a member? Log in

By using this website, you agree to our use of cookies. We use cookies to provide you with a great experience and to help our website run effectively in accordance with our Privacy Policy and Terms of Service.