Corporate concentration raises profits and lowers productivity

Peter Josty is Executive Director of The Centre for Innovation Studies, based in Calgary.

Peter Josty is Executive Director of The Centre for Innovation Studies, based in Calgary.

It is well known that Canada has many concentrated markets, for example telecoms, grocery stores railways and others. What are the consequences that arise from these concentrated markets?

Measuring industry concentration

There are several ways to measure industry concentration.

You can measure the share of the top four or 10 companies (the concentration ratio) in a market or calculate a concentration index.

The index used in the new Competition Act in Canada is the Herfindahl-Hirschman Index (HHI). This is the Index the U.S. Department of Justice has used for many years. It is the sum of squares of the percent market shares of all market participants.

Concentration of Canadian industries

In their book The Big Fix, Denise Hearn and Vass Bednar describe the concentration of Canadian industries in great detail.

Beyond the usual suspects (three major telecommunications companies, five grocers, two major airlines, one train company and a few big banks) they list many other highly concentrated industries.

They included, for example, a major cinema company (Cineplex, with 75 percent market share), veterinary clinics, fertilizer manufacturers, sunglasses and funeral directors.

Is concentration increasing?

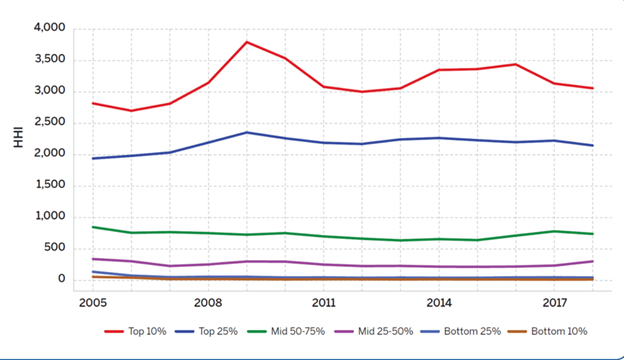

A report from the Competition Bureau showed that concentration in many Canadian sectors has been increasing. The graph below shows the average annual HHI from 2005 to 2018 for industries that are grouped by average HHI. The top 10 most concentrated industries are shown in the red line.

As a point of reference, the U.S. Department of Justice has a threshold of HHI of 1800 to investigate a potential merger for anti-competitive behaviour. So, a significant part of the Canadian economy is above this level.

A report from SSRN showed that the average HHI index has increased in the past two decades across the majority of industries in Canada.

The increase in industry concentration is also economically significant with about one-third of Canadian industries experiencing a more than 50 percent increase in the HHI level. The largest firms have become more dominant.

Two factors can explain the increase in industry concentration – lax enforcement of anti-trust laws, and the role of technological innovation in creating economies of scale and raising barriers to entry.

Corporate profits

The first place to look for the impact of corporate concentration is corporate profitability, as one key aspect of concentrated markets is that they are less competitive; companies have more market power and find it easier to raise prices.

In Canada, corporate profits made up 20 percent of GDP in 2023, compared with only 13 percent in the U.S. That is a stark reminder that Canadian companies are much more profitable overall than U.S. companies.

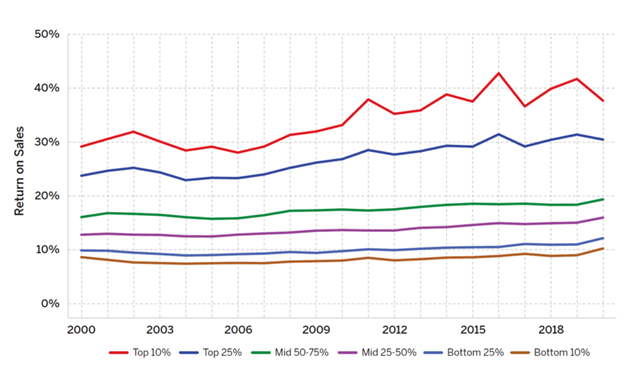

The same Competition Bureau report referenced above shows that the profitability of Canadian firms has been increasing, particularly those that are most profitable. The graph below shows the annual return on sales from 2000 to 2020 for industries that are grouped by average return on sales.

Productivity

At the same time that corporate concentration has been rising, productivity has been declining.

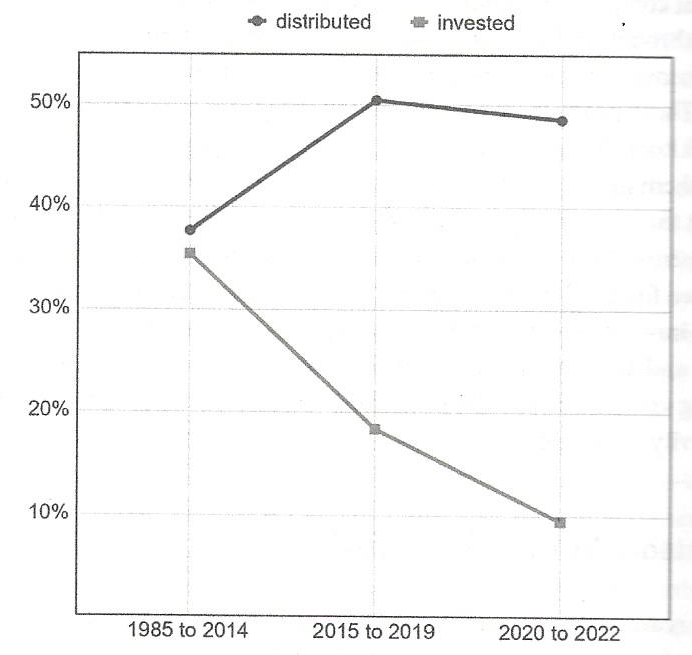

You might think that with their extra profits companies could invest more in increasing their productivity. But that hasn’t been happening. The graph below shows that corporations have been investing less and returning more to shareholders as dividends.

Source: The Big Fix, page 53.

This decline in investment is also shown by a declining rate of research and development spending and a decline in spending on worker training.

In The Big Fix the authors comment: “As markets become concentrated, dominant companies no longer need to compete vigorously and invest in innovation. Unproductive companies rest on their laurels.”

Big companies have been investing in acquiring other often unrelated companies to grow by acquisition rather than investing in their main business. The Big Fix provides numerous examples:

- Loblaws owns 12 different retail brands (including No Frills, Zehrs, Superstore, and Shoppers Drug Mart).

- Canadian Tire owns 10 retail brands including Sport Chek, Helly Hensen, Atmosphere, Sports Experts, and Hockey Life.

- Rogers owns four telecommunications brands, including Shaw, Fido and Chatr, as well as many unrelated businesses such as the Toronto BlueJays, Toronto Raptors, Citytv, CPAC, and Omni.

- Telus owns Koodoo, Public Mobile, TELUS Health, TELUS Virtual Pharmacy, TELUS Virtual Care and TELUS Agriculture.

As the authors note, these multiple brands create the illusion of competition.

Conclusion

The concentration of many Canadian markets is increasing and this is increasing profits and is a major factor behind the decline in productivity in recent decades. Reversing this trend would make the economy more productive.

R$

| Organizations: | |

| People: | |

| Topics: |

Events For Leaders in

Science, Tech, Innovation, and Policy

Discuss and learn from those in the know at our virtual and in-person events.

See Upcoming Events

You have 0 free articles remaining.

Don't miss out - start your free trial today.

Start your FREE trial Already a member? Log in

By using this website, you agree to our use of cookies. We use cookies to provide you with a great experience and to help our website run effectively in accordance with our Privacy Policy and Terms of Service.