Canada set to be a world leader in building the next generation of nuclear reactors, industry experts say

Editor’s Note: For another perspective on developing new nuclear energy in Canada, see the accompanying story: “Building new nuclear reactors in Canada is not the solution to the climate crisis.”

Canada is seeing a nuclear "renaissance," industry leaders say

Canada is poised to lead the world in building the next generation of nuclear reactors providing permitting and regulatory approvals are more efficient and the country has a bold vision, industry experts say.

Canada’s nuclear industry is on track to build the world’s first commercial-scale, electricity grid-connected small modular reactor at the Darlington, Ontario nuclear site and plans to build several new large conventional nuclear power reactors, they said during a webinar sponsored mainly by the nuclear energy industry.

“It’s a really exciting time for nuclear power, not only here in Ontario and Canada but frankly around the world,” said James Scongack (photo at right), chief operating officer and executive vice-president at Bruce Power.

“It’s a really exciting time for nuclear power, not only here in Ontario and Canada but frankly around the world,” said James Scongack (photo at right), chief operating officer and executive vice-president at Bruce Power.

Bruce Power is about halfway through refurbishing six reactors at Ontario’s Bruce Power Station – the world’s largest operating nuclear site – so they can continue operating into the 2070s, he said.

The $13-billion refurbishment project (photo at left), scheduled to be completed in 2033, “remains on time and on budget,” Scongack said.

The $13-billion refurbishment project (photo at left), scheduled to be completed in 2033, “remains on time and on budget,” Scongack said.

Bruce Power’s reactors currently deliver about one-third of Ontario’s electricity and are also one of the world’s largest producers of medical isotopes.

Toronto-headquartered Aecon Group Inc. is involved in a leading role in the refurbishment of the Bruce Power reactors.

Aecon also has nearly completed refurbishing four reactor units at the Darlington site for Ontario Power Generation (OPG), said Aaron Johnson, senior vice-president, nuclear, at Aecon. The company also soon will be involved in refurbishing four more units at the Pickering Nuclear Generation Station for OPG.

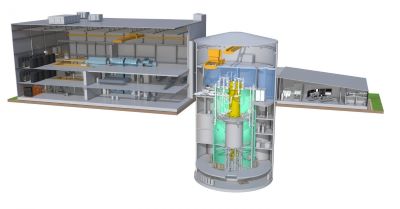

Aecon also is Canada’s constructor for the country’s first grid-scale small modular reactor (SMR) – the first in the Western world – at the Darlington nuclear site. That SMR will be using the GE Hitachi BWRX-300 reactor technology (artist's rendering at right).

Aecon also is Canada’s constructor for the country’s first grid-scale small modular reactor (SMR) – the first in the Western world – at the Darlington nuclear site. That SMR will be using the GE Hitachi BWRX-300 reactor technology (artist's rendering at right).

“We’re at a point in time here where we have a fantastic opportunity for this province, for this country,” said John MacQuarrie (photo at left), president of commercial operations at BWXT Nuclear Energy Canada.

“We’re at a point in time here where we have a fantastic opportunity for this province, for this country,” said John MacQuarrie (photo at left), president of commercial operations at BWXT Nuclear Energy Canada.

“We could choose to be very bold here and just say We’re going to build 16 big reactors [and] we’ll build some small ones, too,” he said. “I think we should do that. I think that should be our policy.

The Canadian Energy Regulator (CER), in its most recent energy forecast scenarios doesn’t project any new large-scale nuclear facilities being built over the projection period (from 2023 to 2050), “as other generation technologies more cost effectively meet growing electricity demand given our assumptions.”

However, in both net-zero scenarios [where Canada continues driving toward net-zero emissions by 2050], the CER projected “considerable growth for small modular reactors (SMRs), particularly in the 2035 to 2050 period. Along with renewable technologies, these nuclear SMR units play a pivotal role in Canada’s electricity system in the net-zero scenarios.”

By 2050, generation from SMRs will make up 12 percent of total electricity generation in both of the CER’s net-zero scenarios, with large SMR additions in Ontario, Alberta, and B.C., the CER said.

To achieve the clean energy transition, Canada’s electricity sector is going to have to double or triple in size, said, Robin Manley (photo at left), president of Toronto-based consulting firm Paradymshyft Nuclear Advisory Ltd. Manley previously led Ontario Power Generation’s process to select a small modular reactor technology partner and design for the Darlington New Nuclear Project.

To achieve the clean energy transition, Canada’s electricity sector is going to have to double or triple in size, said, Robin Manley (photo at left), president of Toronto-based consulting firm Paradymshyft Nuclear Advisory Ltd. Manley previously led Ontario Power Generation’s process to select a small modular reactor technology partner and design for the Darlington New Nuclear Project.

It’s important for Canada to learn from past experiences in building nuclear reactors, she said. “When you’re going to try to do a first-of-a-kind [small modular reactor] and then deploy a fleet of those reactors, you want to gain the efficiencies and you want to learn from the mistakes we’ve made in the past and do it better this time, so that it’s more effective, more efficient, faster and cheaper.”

Manley said one thing she hears from companies interested in deploying a first nuclear project is a concern about uncertainty, with regulatory uncertainty being No. 1 on their list along with policy uncertainty.

Johnson from Aecon Group acknowledged that the first nuclear reactor unit built at Darlington wasn’t the best, nor was the first unit built at the Bruce Power nuclear site, and “the very first SMR unit will not be the best.”

But subsequent reactor units are tens of percent faster and cheaper than units built before them, he noted. “It’s a ruthless appetite and a ruthless dedication to continuous improvement and getting better, faster, stronger, higher quality, safer, cheaper.”

Canada will need a fleet of new reactors to achieve the clean energy transition

A key to building big infrastructure like nuclear reactors is to have predictability, Johnson said. “We need to know when, we need to be able to plan for it, and we need to have that long-term ability to put programs in place to develop people [the workforce].”

Scongack from Bruce Power said one of the biggest challenges with new nuclear and other large infrastructure projects is the length of time it takes to get permitting and regulatory approvals. “It takes longer to permit a project than it does to construct it.”

If it’s unpredictable when a project will start, it’s very difficult to plan investment and recruitment and sequencing of a workforce, he said.

In advocating for a fleet buildout approach, Scongack said: “Nuclear plants are like potato chips. You just can’t have one.”

Building a fleet of new reactors in sequence offers several advantages, he added, including offering Indigenous communities a better investment opportunity and access to federal and provincial loan programs.

Bruce Power is looking at building up to 4,800 megawatts of new nuclear power capacity at its existing Bruce Power site on the shores of Lake Huron. The company has initiated a federal impact assessment and is looking at technology options, Scongack said.

A new nuclear power plant can’t be built overnight, he said. “But I would say we’re faster than [building Toronto’s new] subway, we’re faster than [constructing] the [Eglinton Crosstown] LRT in Toronto, and we’re faster than the renovation on Parliament Hill. So we’re doing something right.”

Manley said her work with the Canadian Nuclear Association indicates Canada will require from 17 gigawatts to 51 gigawatts of new nuclear energy. In order to provide reliable, 24-7, 365-days-a-year [electricity], she added, “nuclear is practically the only thing that’s going to get it done in most of the country.”

Scongack pointed out that the Trump administration in the U.S. wants to see energy dominance in North America, to reduce the reliance on other jurisdictions around the world.

“There’s a real opportunity for Canada and Ontario to play an important role in that,” he said.

Trump also committed during the election campaign that he would focus on affordability and reduce the cost of energy to families by 50 percent in one year, Scongack said.

“You only achieve that through strong energy collaboration between the U.S. and Canada,” he added, whether this involves low-cost oil and gas, expanding the electricity interties between Ontario and the U.S., the uranium supply that comes from Cameco and Port Hope, or Canada’s supply of medical isotopes.

“You can’t have economic security and stability and have affordability if you don’t have energy security,” Scongack said.

Amid the current tensions around trade and tariffs, Canada “is really at a fork in the road,” he said.

“We’re at a fork in the road where we’re going to take the high road and find a way of aligning those interests and finding a win-win. Or we’re going to take the low road, and the low road is one of tariffs and high inflation.”

MacQuarrie from BWXT Nuclear Energy Canada noted that “we have a remarkable industry here in terms of [having] a great regulator, great operators and a really strong supply chain. Very few countries have that capability that we have.”

Multiple benefits from new nuclear touted but costs have yet to be identified

John Gorman (photo at right), president of Westinghouse Canada, said the landscape for new nuclear energy has shifted in Canada during the last few years.

John Gorman (photo at right), president of Westinghouse Canada, said the landscape for new nuclear energy has shifted in Canada during the last few years.

“We went from a period of not being able to find a federal minister to say the word ‘nuclear’ to having incredible recognition and support for nuclear as being pivotal to our clean energy future.”

The most recent polling by the Angus Reid Institute shows that 63 percent of Canadians now favour building new nuclear plants, Gorman added. “We went from getting recognition and support to having to execute. Now it’s about execution.”

Westinghouse, one of the world’s leading designers of nuclear reactors, is 100-percent Canadian-owned, Gorman noted.

The company has six of its AP1000 pressurized light water reactors in operation and expects to have 18 AP1000 units operating by the end of this decade, he said.

“If we can keep this first-mover advantage, if we can continue to expand our capacity, we’ll be able to do that with AP1000s here at home while also participating in the huge global market,” Gorman said.

Westinghouse also has developed a micro-reactor designed for off-grid communities, Northern communities and Arctic deployment, he said.

The company is building the world’s first commercial micro-reactor, called the eVinci, in Saskatchewan with the Saskatchewan Research Council.

Gorman said Westinghouse also has a 300-megawatt small modular reactor, the AP300, that the company hopes to deploy initially in New Brunswick.

Another nuclear energy developer in Canada is Montreal-based AtkinsRéalis, which owns the CANDU heavy water reactor technology and has 22 CANDU reactors deployed in Canada.

AtkinsRéalis supports the fleet of CANDU reactors, including their current refurbishments and ongoing maintenance, said Gary Rose (photo at left), executive vice-president of nuclear in Canada for AtkinsRéalis and president and CEO of its subsidiary, CANDU Energy.

AtkinsRéalis supports the fleet of CANDU reactors, including their current refurbishments and ongoing maintenance, said Gary Rose (photo at left), executive vice-president of nuclear in Canada for AtkinsRéalis and president and CEO of its subsidiary, CANDU Energy.

CANDU reactors don’t require enriched fuel, a process currently done by six other countries and which isn’t done in Canada.

CANDUs, which use processed uranium mined in Saskatchewan as fuel, also are the only reactors that can produce medical isotopes at the same time as they’re producing electricity, Rose noted.

CANDU Energy also has announced it’s working on the Monark, a 1,000-megawatt “modernized” CANDU reactor. The more CANDUs that can be deployed in Canada, the higher the economic value the country will receive from them, he said.

“In the human history of nuclear, there has never been a redesigned or new nuclear plant that has gone according to plan, been on time and on budget,” Gorman said. “It’s really hard, it takes a really long time, it’s really expensive.”

“So if Canada is going to do this dual-technology [of light-water and heavy-water reactors] then let’s make sure we plan accordingly and support it.”

Light water reactors use regular water and slightly enriched uranium as fuel, while heavy water reactors use heavy water, a chemically distinct type of water with a higher density, and use natural processed uranium as fuel.

According to a 2024 report by PricewaterhouseCoopers LLC and commissioned by Westinghouse, the manufacturing, engineering and construction phases of four AP1000 units could generate more than $28.7 billion of GDP impact for Canada and over 125,000 person-years of employment.

Once operational, the units would create an additional $8.1 billion in GDP and support more than 12,000 jobs annually, the report said.

A separate report, by the Conference Board of Canada, said the construction and operation of one small modular nuclear reactor in Darlington, Ont. can generate $2.6 billion in GDP, $1.7 billion in wages, and $873 million in taxes for Ontario’s economy.

In Saskatchewan, deploying a fleet of small modular reactors identical to the Ontario SMR’s design can generate $8.8 billion in GDP, $5.6 billion in wages, and $2.9 billion in taxes for the province.

“You just can’t beat the jobs [created] and GDP contributions that come from nuclear. It’s extraordinary,” Gorman said.

However, none of the panelists during the webinar identified what new large conventional reactors or new SMRs in Canada will cost, although the price tag on the first SMR at Darlington alone is expected to be several billions of dollars.

See also: Taking a close look at the benefits and risks of small modular reactors

Debate intensifies over using reprocessed spent fuel in small modular reactors

Could small modular reactors help achieve Canada’s net-zero emissions goal?

R$

| Organizations: | |

| People: | |

| Topics: |

Events For Leaders in

Science, Tech, Innovation, and Policy

Discuss and learn from those in the know at our virtual and in-person events.

See Upcoming Events

You have 0 free articles remaining.

Don't miss out - start your free trial today.

Start your FREE trial Already a member? Log in

By using this website, you agree to our use of cookies. We use cookies to provide you with a great experience and to help our website run effectively in accordance with our Privacy Policy and Terms of Service.

.jpg)

.jpg)